| This content applies solely to Connected Claims, which must be purchased separately from the Appian base platform. This content was written for Appian 24.2 and may not reflect the interfaces or functionality of other Appian versions. |

OverviewCopy link to clipboard

When processing any type of insurance claims, from property and casualty (P&C) to disability and life, a provider's ability to deliver an exceptional and personalized experience is the most important objective. In order to do so, they must be able to provide customized and superior claims management with accuracy and agility that digitally engages their customers. Yet all to often, claims operations teams are often challenged with juggling multiple systems that slow down the claims process, which increases the potential for:

- Increase in claims leakage and costs

- Inaccurate decision making

- Delayed claims settlement

- Inefficient claims operations and processes

- Increase in the number of fraud incidents or litigation

- Poor customer retention due to a failure to meet customer expectations

Built on the Appian Low-Code platform, the Appian Connected Claims solution delivers a 360-degree view of each claim as it moves through each stage of the claims processing life cyle. As the name implies, it is "Connected" throughout your claims organization via the solution's unique design & architecture. This means that as you navigate between the solution's actionable dashboards, you can access and view claim data pulled in from all claim systems, policy systems, and 3rd-party applications. This enables your organization to streamline its claims process, mitigate claims leakage, and provide an excellent customer experience throughout the claims life cycle.

Connected Claims also comes with the following integrations that you can easily configure for your solution:

- Amazon S3

- Amazon Comprehend Services

- DocuSign

- Google Cloud Bucket

- Google Maps

- Google ML Kit

- Salesforce

- SurveyMonkey

Unify your data and empower your processCopy link to clipboard

Connected Claims unifies your data and powers your claims processing by bringing all your data into one place. Having all this information at your fingertips allows you to:

- Eliminate duplicative, manual processes and increase staff productivity and efficiency.

- Make your process more efficient by spending less time searching for data.

- Optimize fraud case management and mitigate fraud risk with a unified view of all potential fraud alerts.

- Make more informed decisions by having all claims, policy, and customer information in one place.

- Increase customer satisfaction by eliminating the need for customers to provide repetitive information, increase straight-through processing, and reduce the time it takes to close each claim.

- Empower your employees to craft a more personal experience for your policyholders by spending more time on interactions and less time on manual tasks.

What does Connected Claims provide?Copy link to clipboard

The Connected Claims solution is a set of 6 modules for P&C insurance claims and 7 modules for disability and life insurance claims. These modules are designed to streamline the claims process at every point in the claims life cycle, from the first notice of loss to claim settlement.

P&C modules include:

- First Notice of Loss

- Fraud Case Management

- Claim Operations and Settlement

- Customer Service

- Litigation & Recovery Management

- Field Inspection

- Continuous Improvement Analysis

Disability and Life modules include:

- Loss Intake (Death Certificate Processing

- Fraud Case Management

- Claim Operations and Settlement

- Customer Service

- VIP and Concierge Mobile Anywhere

- Continuous Improvement Analysis

With so much to offer, this Connected Claims overview page focuses on providing a brief description of each P&C module in the solution.

First Notice of LossCopy link to clipboard

First Notice of Loss (FNOL) begins the P&C claims lifecycle. This module facilitates efficient and intelligent claims intake, which improves customer experience, reduces operational costs, and allows you to manage the claims intake process with precision and ease.

The FNOL module also use the Appian Intelligent Contact Center (ICC) solution to empower and improve your claims process. ICC provides multiple forms of communication that enable you to improve your customer interactions and response times. For example, with ICC, your customer service agents can interact with customers using omni-channel capabilities (e.g. calls, chats, SMS) while leveraging Dynamic Case Management driven by Appian Records and Intelligent Automation. This allows your agents to deliver a best-in-class customer experience each and every time they start the intake process for a new P&C claim. During high volume FNOL intake periods, such as regional or global catastrophes, Omnichannel capability is especially important for insurers delivering on their critical moment-of-truth insurance claims promise.

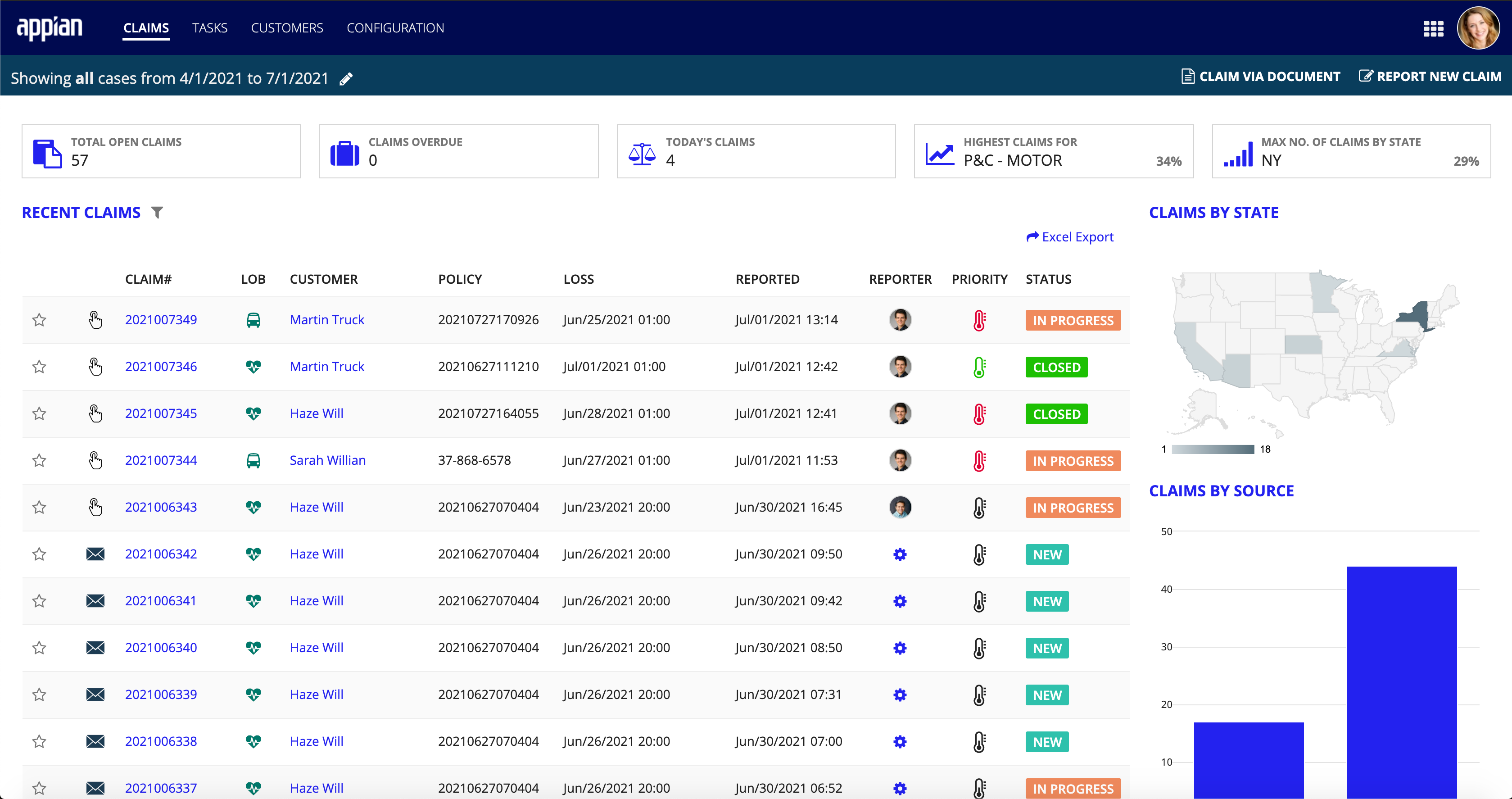

From the FNOL dashboard's CLAIMS page, you can view a list of recent claims, along with all associated information and any parties or entities involved in each claim. Track the claim as it moves through every stage of the claims life cycle so you know exactly where a claim is in the process at any given time.

Fraud Case ManagementCopy link to clipboard

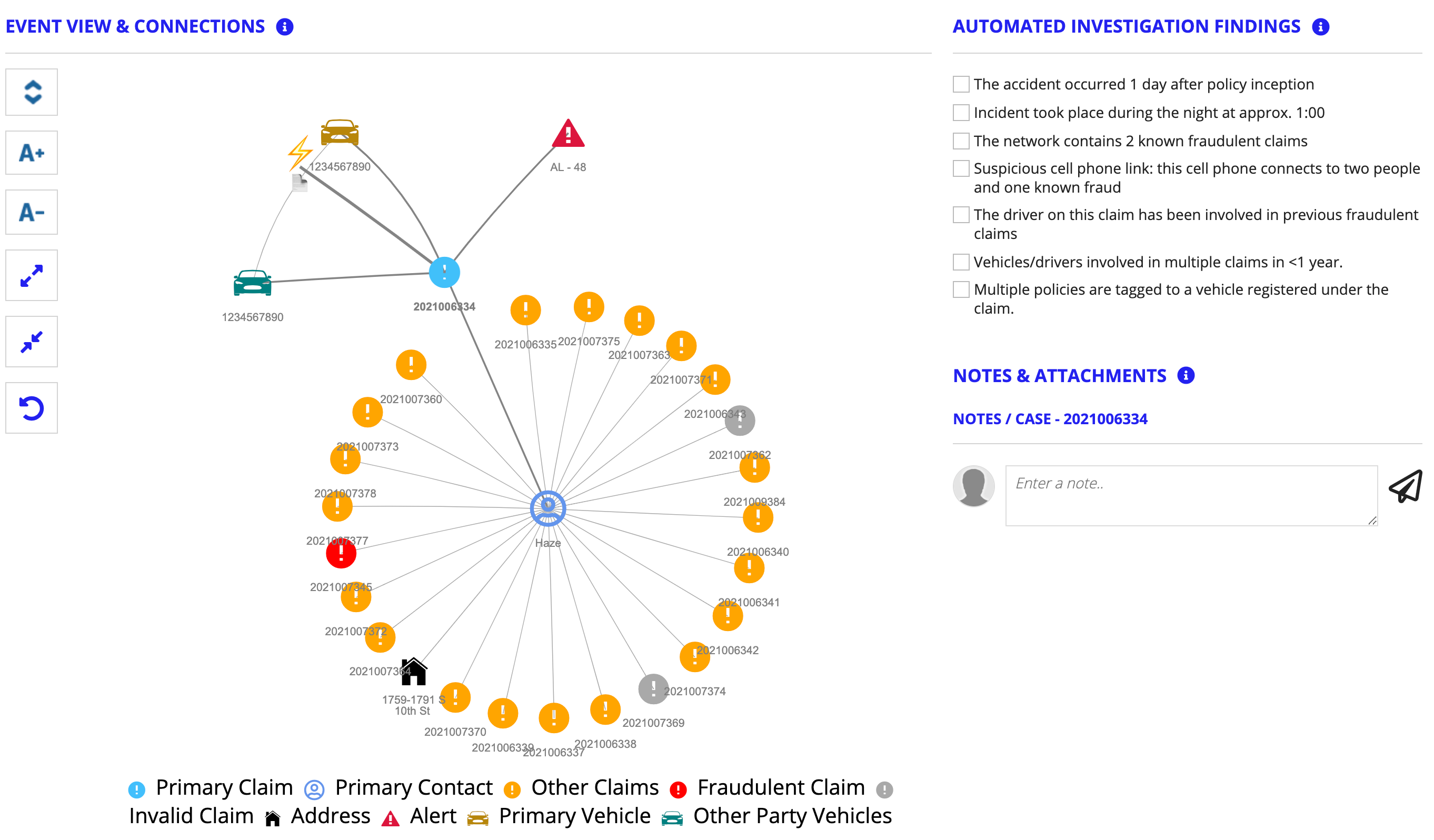

The Fraud Case Management module integrates with your existing fraud system to provide a unified view of all of your fraud alerts. This view includes a fraud checklist to let you know exactly which suspicious activities have flagged the claim. Drillable alert visualizations allow you to see all of the connection points for each alert, including the claim, policyholder, and related entities.

These visualizations provide a larger picture of the event and connection points, which helps your Special Investigation Unit (SIU) teams see data relationships that might not otherwise have been clear. When you need more detailed information, simply drill down into each node to view key connections at a glance and access more details about the event's alerts. This view also provides an automated list of investigation findings that you can select to view exactly when a specific point in the event takes place and access any case notes.

All of these features work together to provide your SIU teams the information they need to investigate cases thoroughly, solve complex problems, and make well-informed decisions.

Claim Operations and SettlementCopy link to clipboard

The Claim Operations and Settlement module allows you to configure workflows for different user personas and streamline processes to reduce the time it takes to close a claim. This can also help reduce your expenses and increase customer satisfaction. With this module, you can confidently configure your own workflows and processes, knowing that they're backed by a fast and efficient platform.

If you need help with your workflows, Connected Claims makes it easy. The Claim Operations and Settlement module also includes pre-configured workflows for the most common insurance types. Quickly select one of these pre-configured workflows as a starting point for specifying your own workflows:

- Automobile

- Life

- Short-term disability

- Long-term disability

- Workers compensation

In addition, this module allows you to easily track a claim as it moves through the process, add case notes, create on-demand tasks, manage reserves, handle single and recurring payments, manage communications and documents. From the CLAIMS page, you can view the Claims list and quickly see completed vs. pending tasks and key claim information. Promote transparency and trust with your policyholders and internal teams by using in-app communication channels to share key information with them.

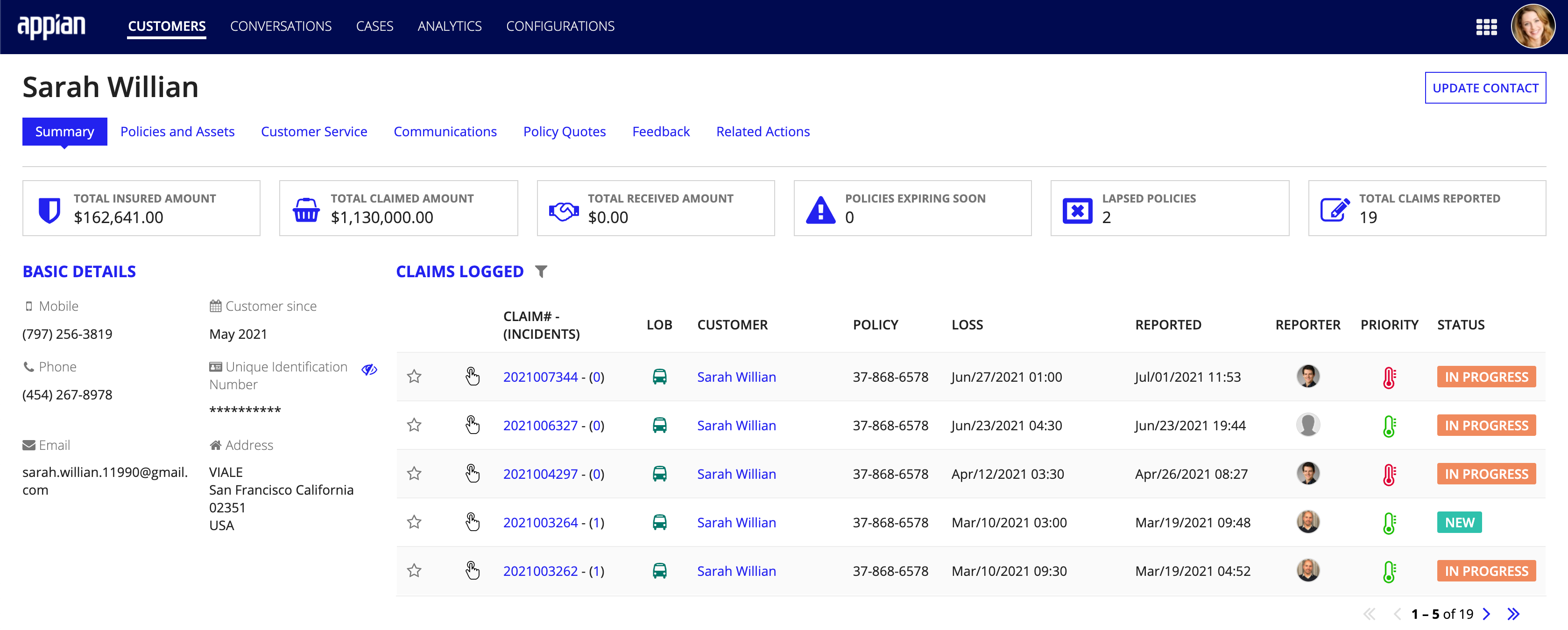

Customer ServiceCopy link to clipboard

The Customer Service module gives you a centralized view of all of your cases within a specific time frame. Quickly configure the date range to view case data for a specific period of time. In addition, the Customer Service dashboard integrate with all of your CRM and legacy systems to provide you with clear, actionable information. Combined with the power of Amazon Connect, this dashboard can help to improve communication between your internal teams by allowing them to communicate quickly and resolve cases with ease.

Empowering your agents and staff with the information and tools they need to efficiently process a claim, allows them to spend less time searching different systems and sites. They can have confidence knowing the have the right information, which allows them to spend more time building a personal, empathy-driven relationship with the customer.

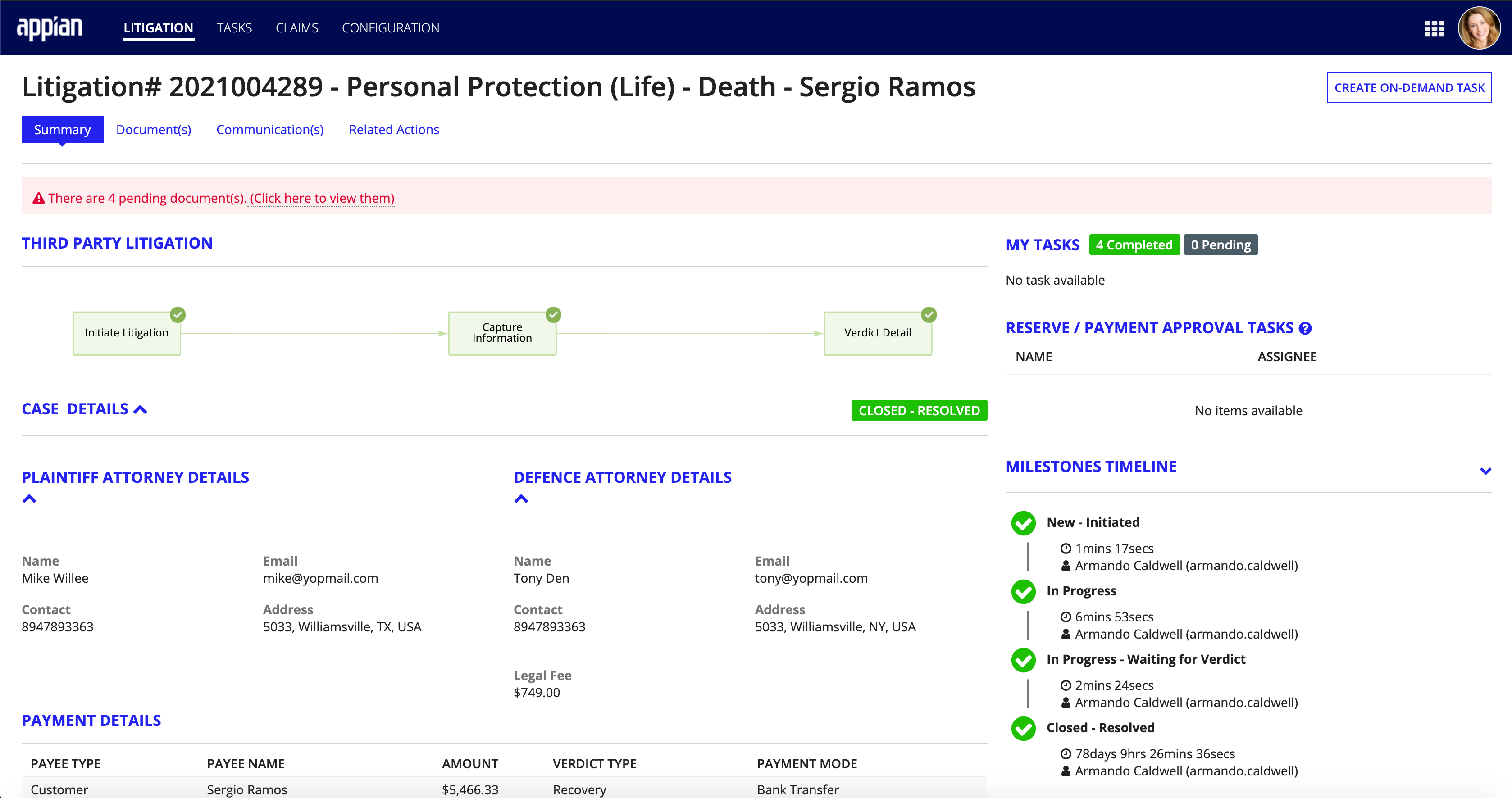

Litigation & Recovery ManagementCopy link to clipboard

The Litigation & Recovery Management module provides unity and clarity to areas of the claims process that require effective collaboration between your external teams and entities.

This module brings visibility and modernity to the litigation process by tracking each case and its details, such as attorney and verdict information. It also empowers adjusters and legal teams to easily and effectively collaborate across multiple channels.

Our recovery dashboard simplifies the subrogation process, making it easy to keep track of funds and avoid paying settlements that should be handled by a third party. The Connected Claims solution makes it quicker than ever for insurers to save money and time while pursuing reimbursement.

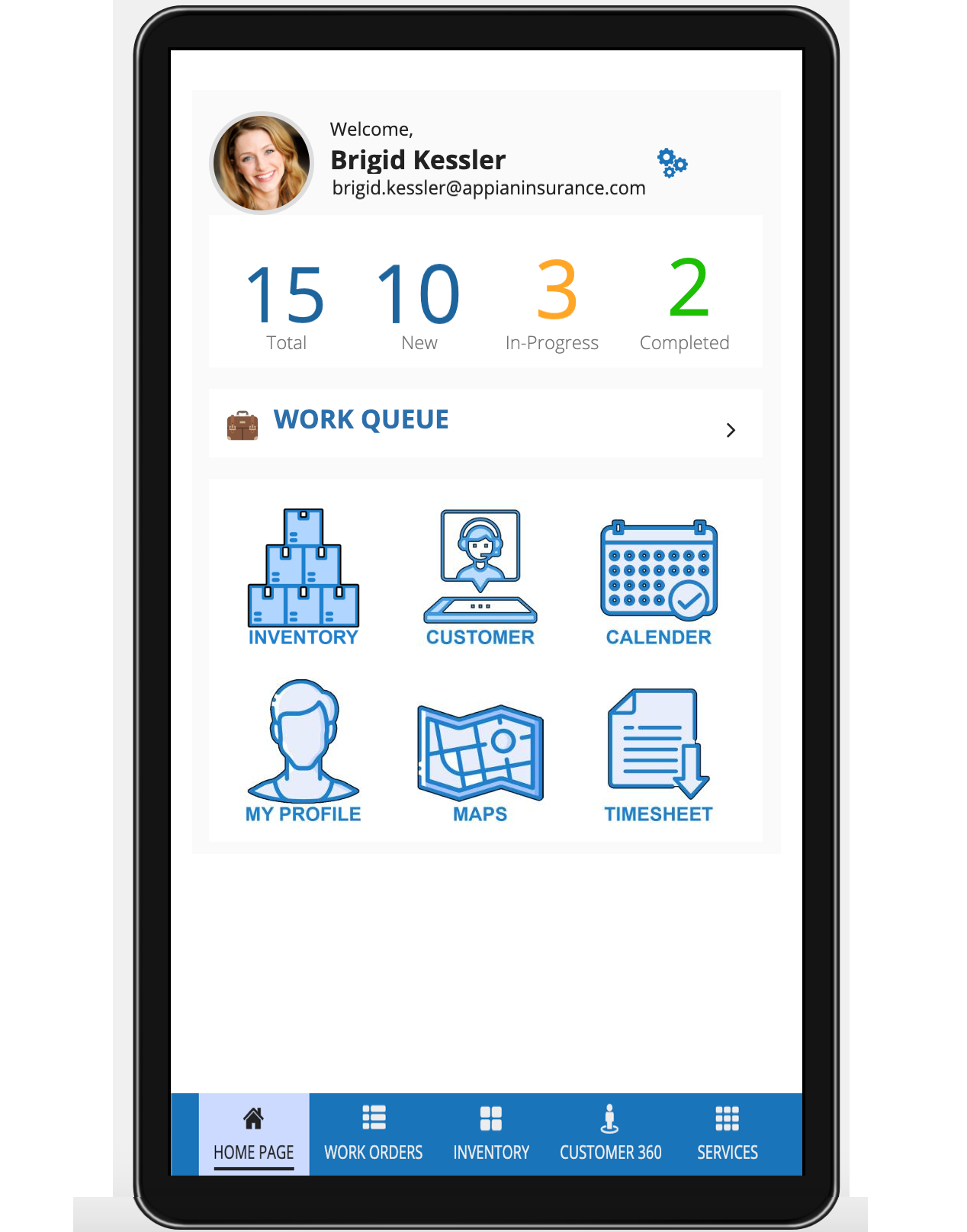

Field InspectionCopy link to clipboard

The Field Inspection module is powered by Appian's native mobile platform and allows you to create mobile schedules and profiles for field inspectors.

Our mobile scheduling experience makes it simple and easy to schedule field inspections and takes the guesswork out of coordinating schedules with multiple parties.

You can also help your policyholders put a face to a name by setting up profiles for each field inspector. Include photos and credentials in each profile and share relevant profiles with your policyholder prior to a scheduled inspection. This helps to promote transparency and foster trust throughout your customer's experience.

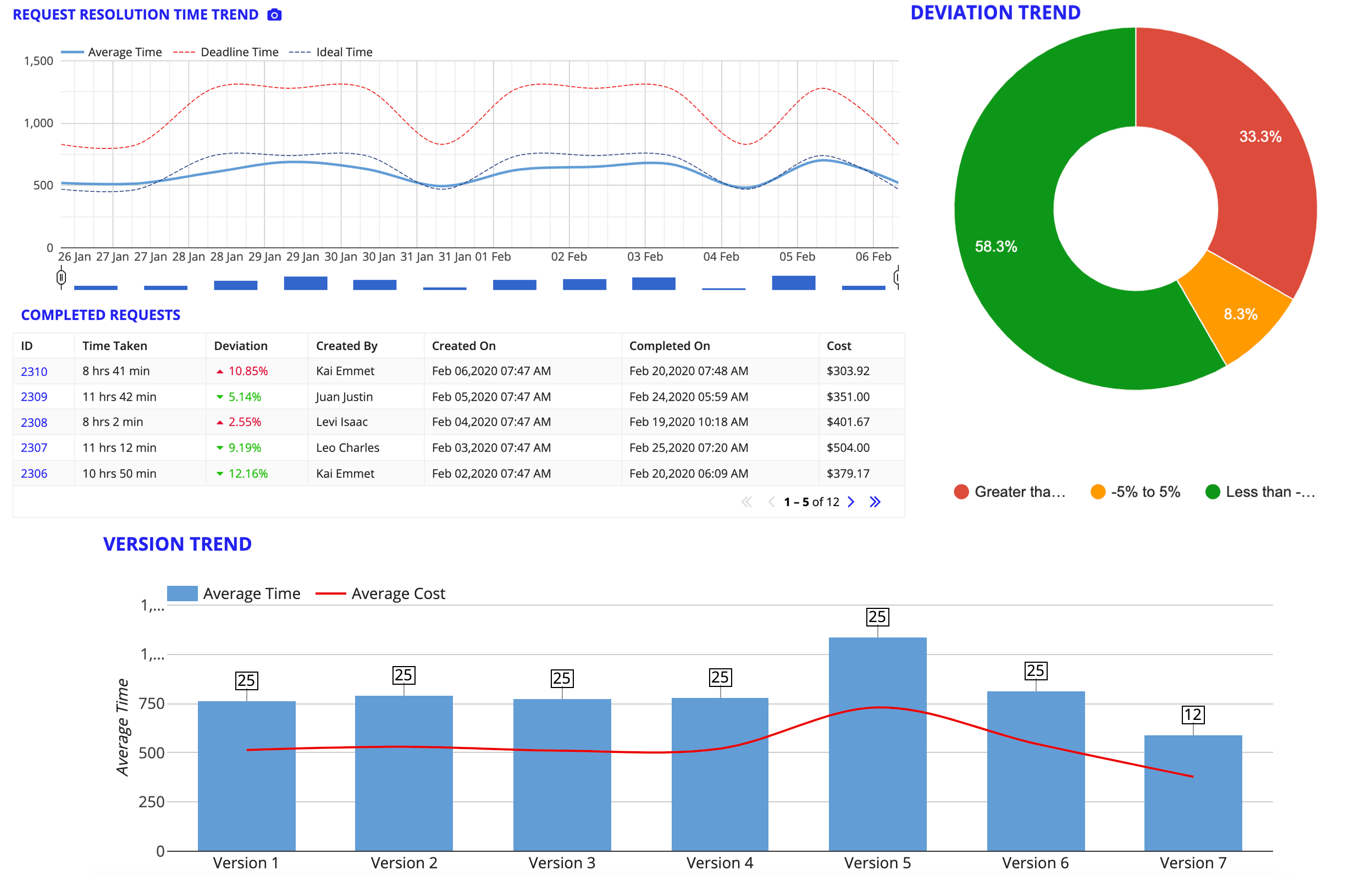

Continuous Improvement AnalysisCopy link to clipboard

The Continuous Improvement Analysis module collects and analyzes data on your claims processes and displays the results in clear terms. This information allows you to make informed decisions about how to improve the performance and efficiency of your claims experience, as well as uncover hidden areas of leakage.

It also provides clear data visualizations that show how your processes have evolved over time. These visualizations can help you identify key areas where you can improve your process.

Next stepsCopy link to clipboard

You can find more information about installation, configuration, and how to use the Connected Claims solution in the Appian Playbook.