| This content applies solely to Connected KYC, which must be purchased separately from the Appian base platform. This content was written for Appian 23.3 and may not reflect the interfaces or functionality of other Appian versions. |

IntroductionCopy link to clipboard

Appian Connected KYC is the third solution in our Connected Financial Services (FS) Suite and is a critical pillar in our customer lifecycle management processes of the customer journey. Connected KYC has been built leveraging our internal industry expertise and experience building out customer specific FS use cases.

This page provides a quick overview of all the ways Appian Connected KYC can help your organization. If you would like a more comprehensive overview of the solution, check out Using Connected KYC starting with the Home Page Overview.

What does Appian Connected KYC provide?Copy link to clipboard

The KYC process doesn’t end after onboarding but rather is continually reinforced between an institution and customer as the customer relationship deepens and extends. KYC can be triggered by a new or changing relationship with the customer, timing (KYC data can expire based on policy) and events (recent negative news or other pertinent data).

Connected KYC eliminates the friction sometimes associated with KYC investigations, significantly reducing false positives and unnecessary investigations, and streamlining the data management of an investigation to reduce risk. It will help achieve a financial institution's goals of reducing risk, improving customer service, and enhancing operational efficiency.

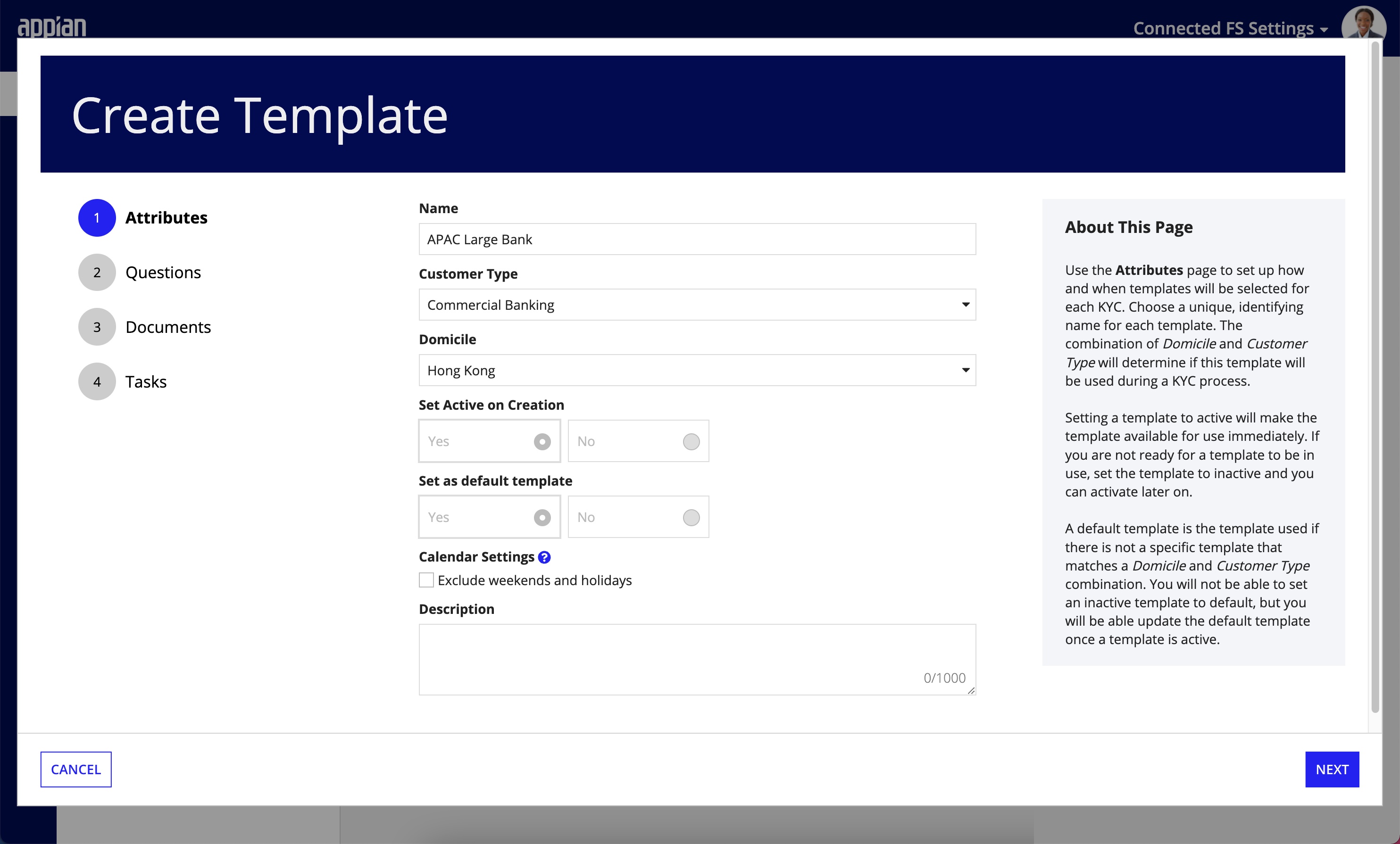

Configurable KYC ProcessesCopy link to clipboard

Business users can fully manage tasks, documents, questionnaires, and different customer types.

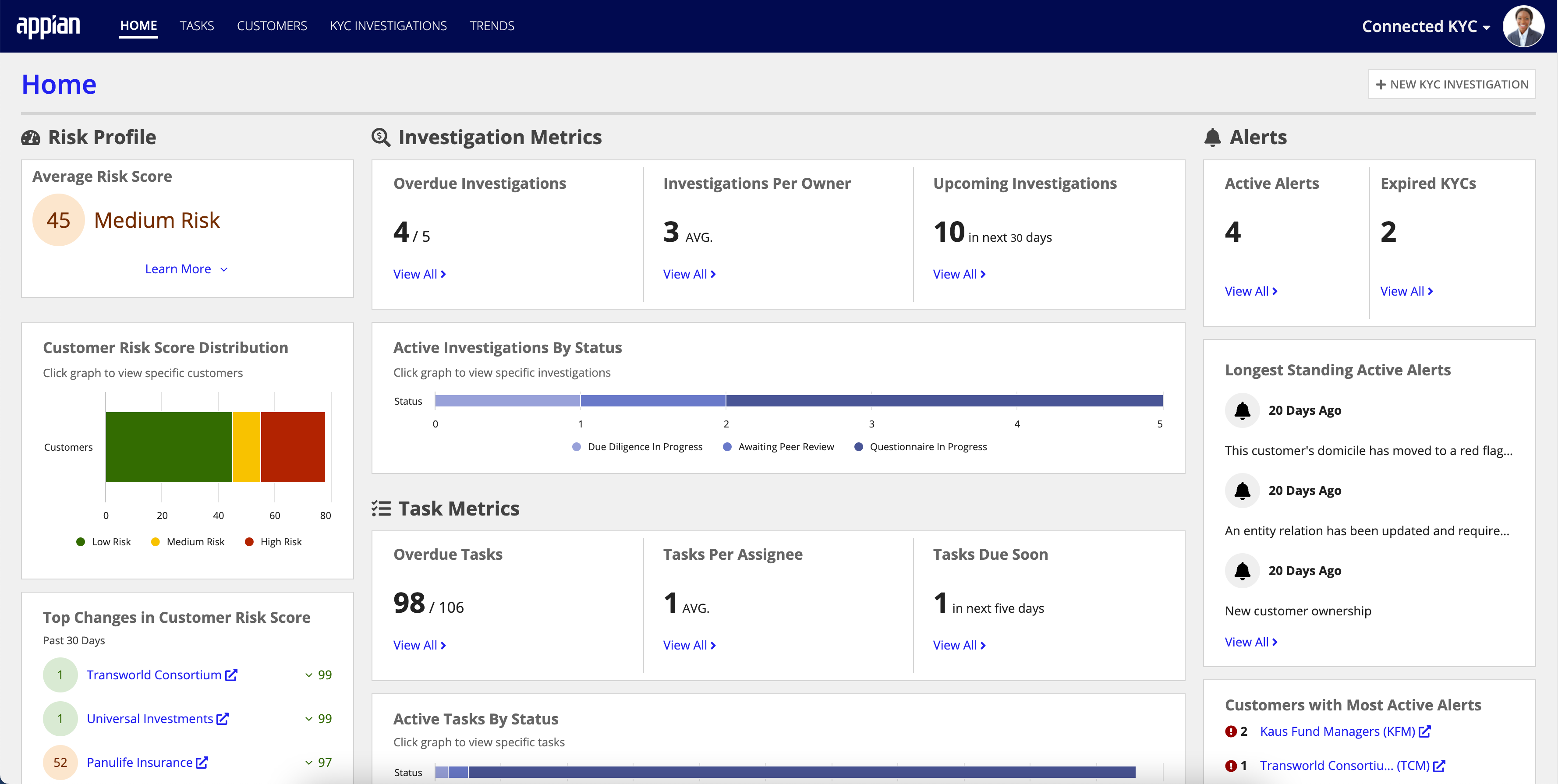

Manager DashboardCopy link to clipboard

Connected KYC gives managers the ability to view the status of all investigations and tasks at a high level. The Connected KYC Home page enables managers to easily identify any issues and escalate any delays before further problems arise.

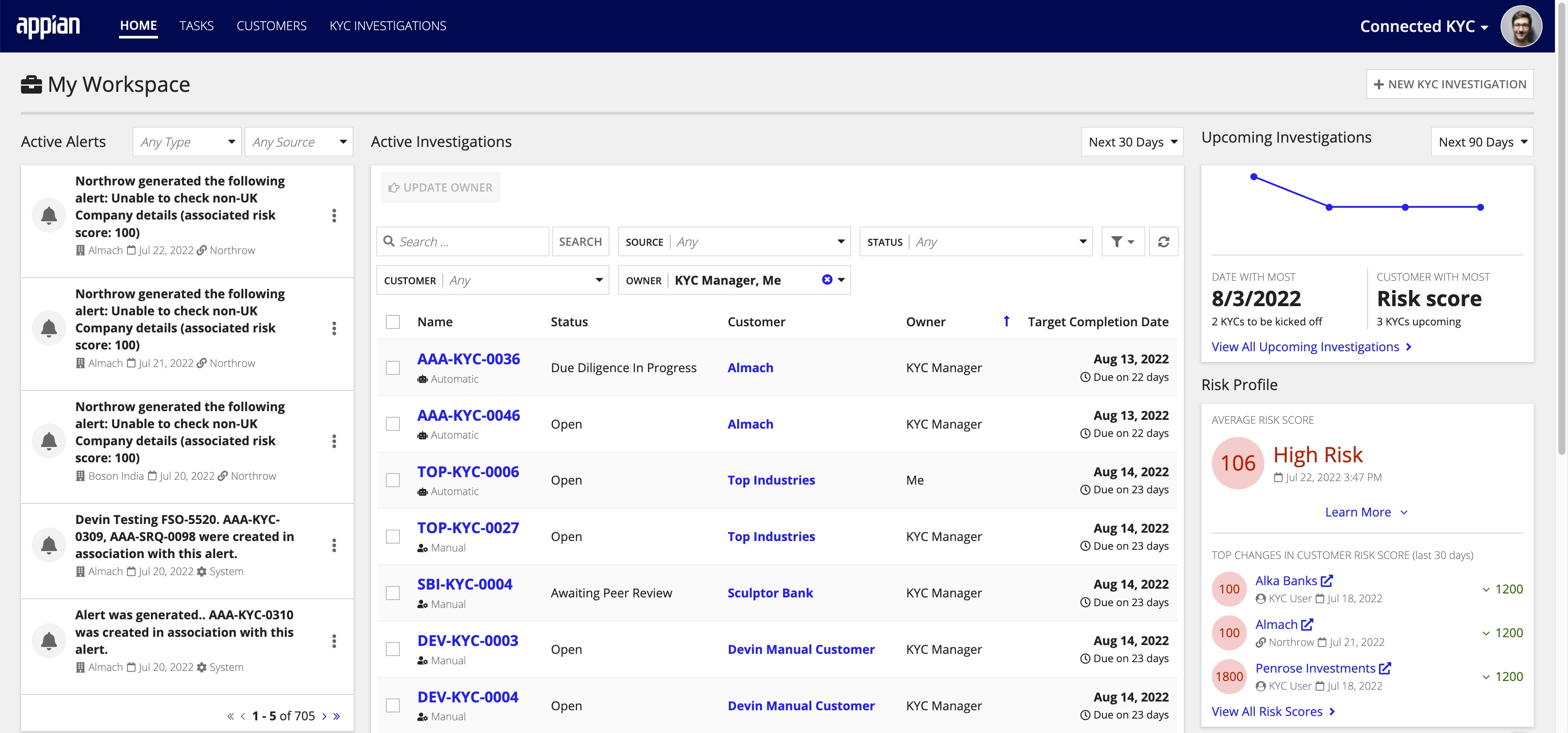

Increased compliance officer focusCopy link to clipboard

Connected KYC allows you to automatically route KYCs that require a manual review based on a custom set of rules determined to reduce unnecessary workload and improve accuracy.

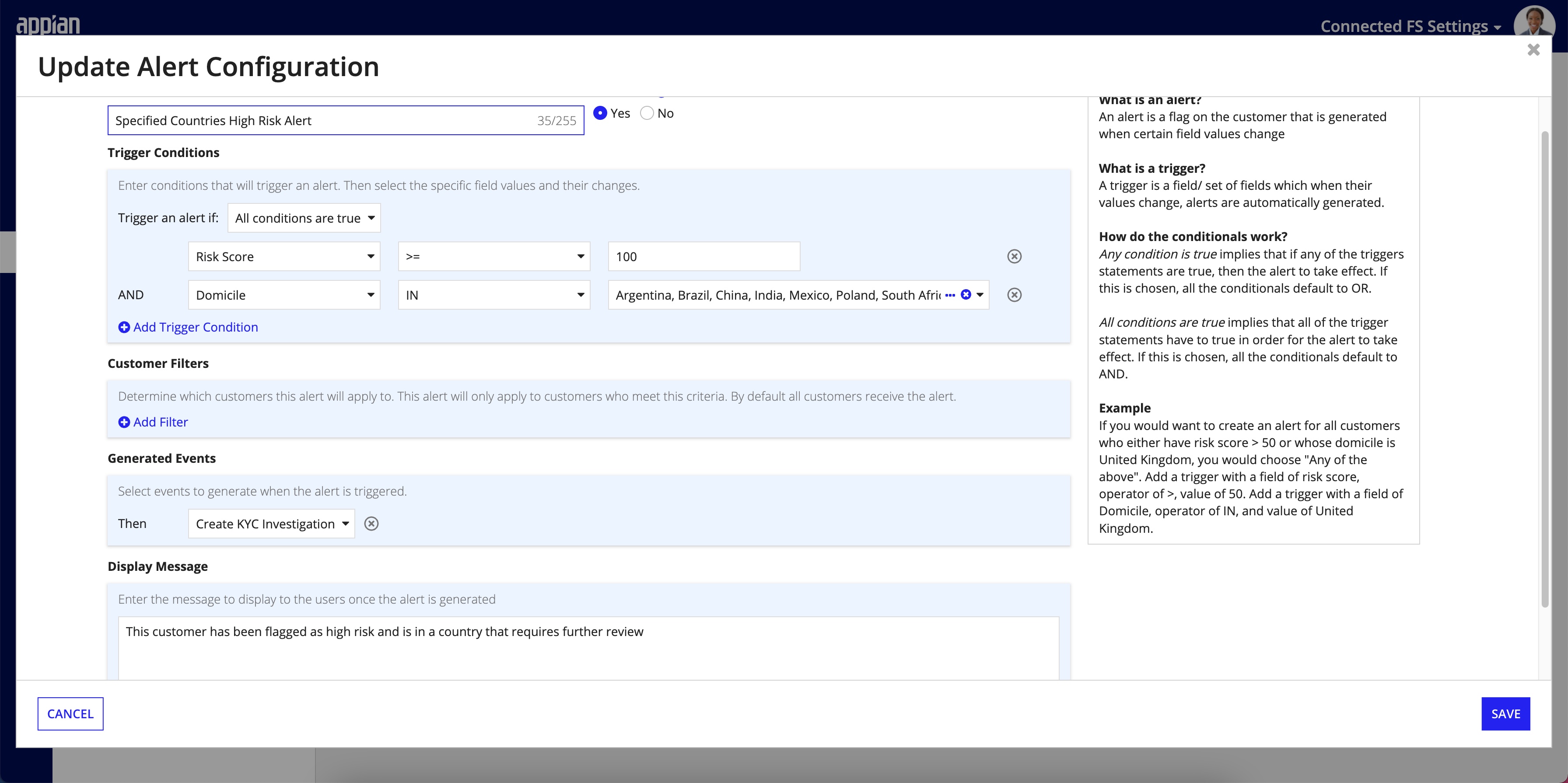

Continuous monitoringCopy link to clipboard

Configure alerts to notify the compliance team of data changes to customer records and automatically open new KYC investigations.

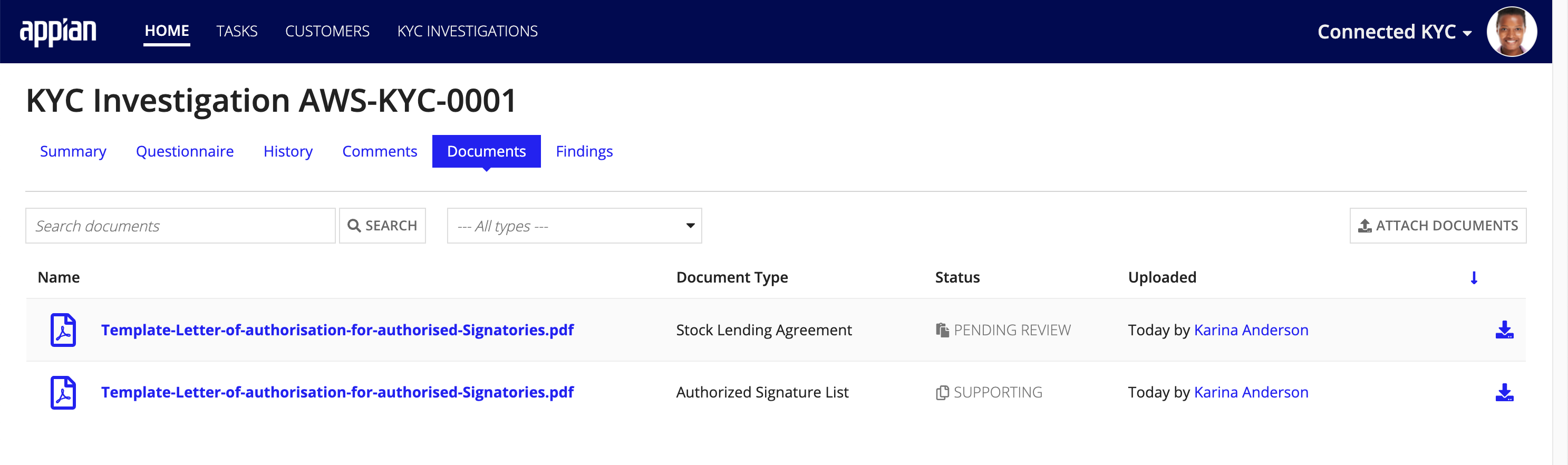

Robust document trackingCopy link to clipboard

Connected KYC allows you to upload, manage, and track the status of documents. Appian's Intelligent Document Processing (IDP) will automatically classify your documents in order to ensure that the correct documents are being reviewed.

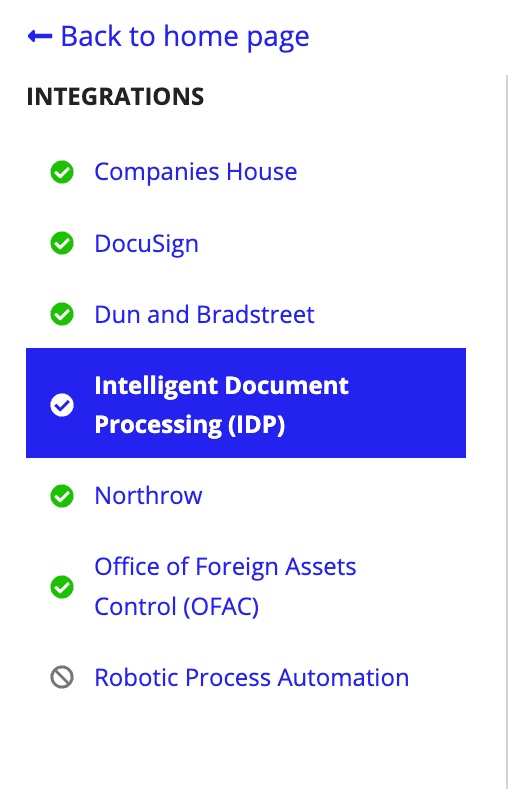

Key data integrationsCopy link to clipboard

Connected KYC integrates with several leading data providers in the financial services space.

Get started nowCopy link to clipboard

Ready to get started? See the Connected KYC documentation, starting with Installing Connected KYC for more information.