| This content applies solely to Connected Underwriting, which must be purchased separately from the Appian base platform. This content was written for Appian 22.4 and may not reflect the interfaces or functionality of other Appian versions. |

The Connected Underwriting 1.1 release notes provide an overview of the latest changes and improvements to the Connected Underwriting Solution. The new features and improved capabilities were designed with best practices in mind.

Connected Underwriting now includes a native integration with Microsoft PowerBI, allowing underwriters to surface customer data and connect reports from other systems directly into their CU solution. After configuring this integration, users can view the new Portfolio View tab from the REPORTS page. The Portfolio View tab provides a dashboard view of any customer and historical claims data pulled in, enabling users to make better, data-driven decisions when evaluating submissions.

This release introduces reporting capability to the Connected Underwriting solution with the REPORTS page, which allows users to quickly pull frequently requested reports and analyze trends across all submissions and team productivity. This page has three main parts: On-Demand Reports, Trends, and Portfolio View.

From the On-Demand Reports tab, underwriters and managers can view and generate ad-hoc reports that show key metrics and details about submissions that match specific criteria. The Trends tab allows underwriting managers to view and analyze trends to better understand their performance. Finally, with a Microsoft PowerBI integration, users can access the Portfolio View tab to surface portfolio data directly in their Connected Underwriting solution in a dashboard view.

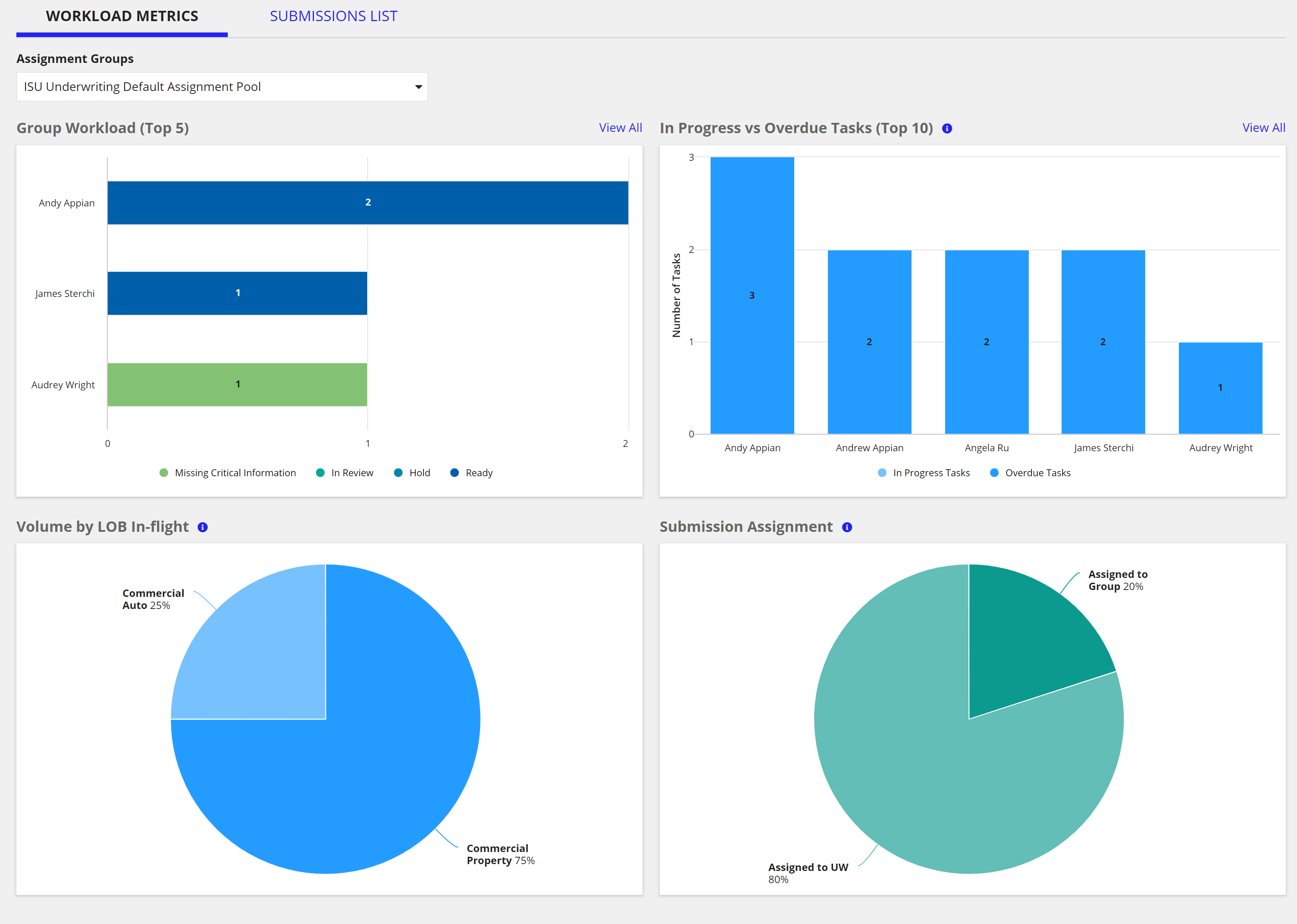

In addition, underwriting managers can also access the new Workbench Metrics tab on MY WORKBENCH to see productivity data about their teams.

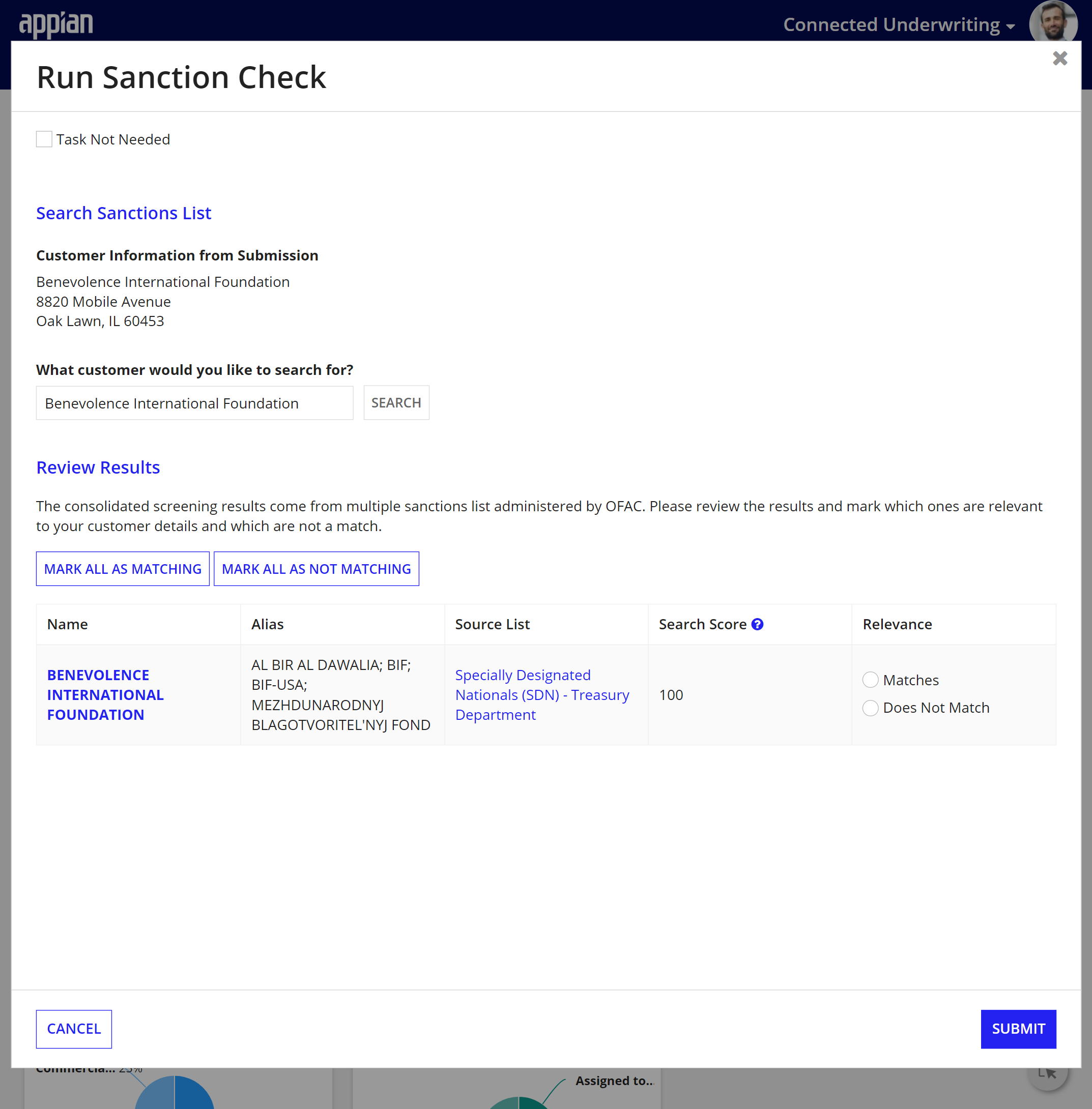

As part of the submissions process, underwriters may need to perform sanctions screenings on a customer as part of a clearance task. Connected Underwriting 1.1 includes an OFAC Consolidated Screening List API integration to automatically verify customers through the Consolidated Screening List API from Trade.Gov. From a Submission record, underwriters can resolve a sanctions screening task, save sanctions results, rerun a sanctions check, and view historical results at the submission and customer levels.

This release also includes improvements to the following Connected Underwriting features:

Connected Underwriting 1.1 Release Notes