| This content applies solely to Connected Underwriting, which must be purchased separately from the Appian base platform. |

IntroductionCopy link to clipboard

Appian Connected Underwriting P&C empowers insurers with a powerful tool to accelerate the underwriting process and improve customer experience. This page provides a quick overview of how Appian Connected Underwriting P&C can help insurance organizations improve their time to quote.

Connected Underwriting P&C provides a single application to consolidate disparate data sources. By reducing the time needed to gather critical information, organizations can accelerate their ability to provide accurate quotes.

If you want a more comprehensive overview of the solution, check out Using Connected Underwriting P&C, starting with the Workbench Overview.

What does Appian Connected Underwriting P&C provide?Copy link to clipboard

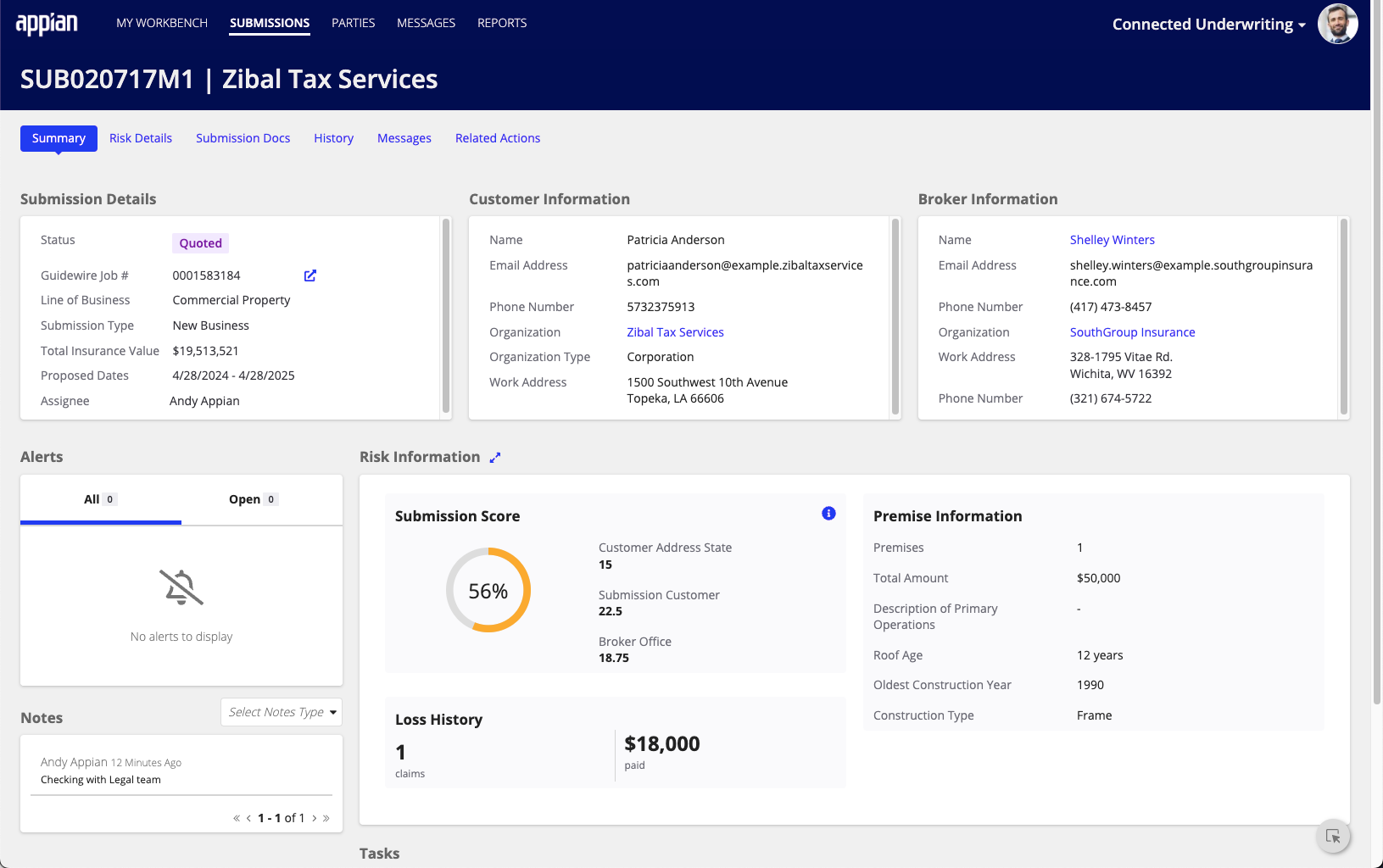

Appian Connected Underwriting P&C streamlines the business-to-quote process by automating the ingestion, clearance, and triage of information needed for an underwriting Submission. The Submission is the key record in underwriting activities.

They are created in two ways:

- Via emails received from insurance brokers.

- Manually created by an underwriter.

Data ingestionCopy link to clipboard

Connected Underwriting P&C uses Appian AI Skills to extract critical data from shared inboxes and incoming submissions. By extracting critical information needed for review, your underwriters are empowered to make the decisions needed to lead the underwriting process and reduce time to quote.

In addition, Connected Underwriting P&C ships with the Guidewire Quote module, which streamlines the quote generation process. Once integrated with the solution, the Guidewire Quote module gives your underwriters the ability to submit new business requests from Connected Underwriting P&C and have the data automatically sent to Guidewire. In addition, you can check your submission against existing customers, create a new customer, create a job and pass information downstream.

Submission clearanceCopy link to clipboard

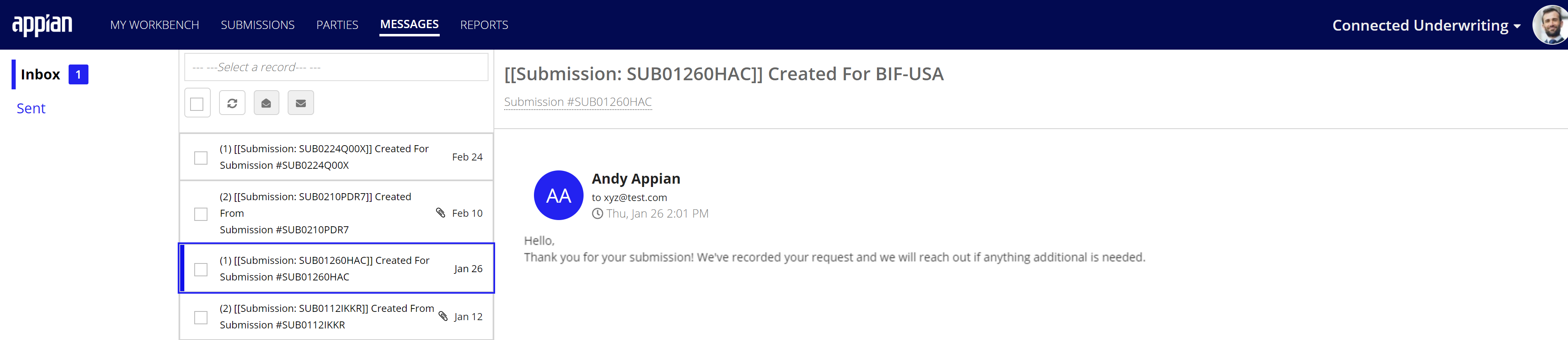

Connected Underwriting allows underwriters to keep track of broker correspondence with AI message summaries, quickly respond with automated emails and follow-ups, as well as ensure submission data completeness, comply with sanctions regulations, and alert underwriters if duplicate submissions exist.

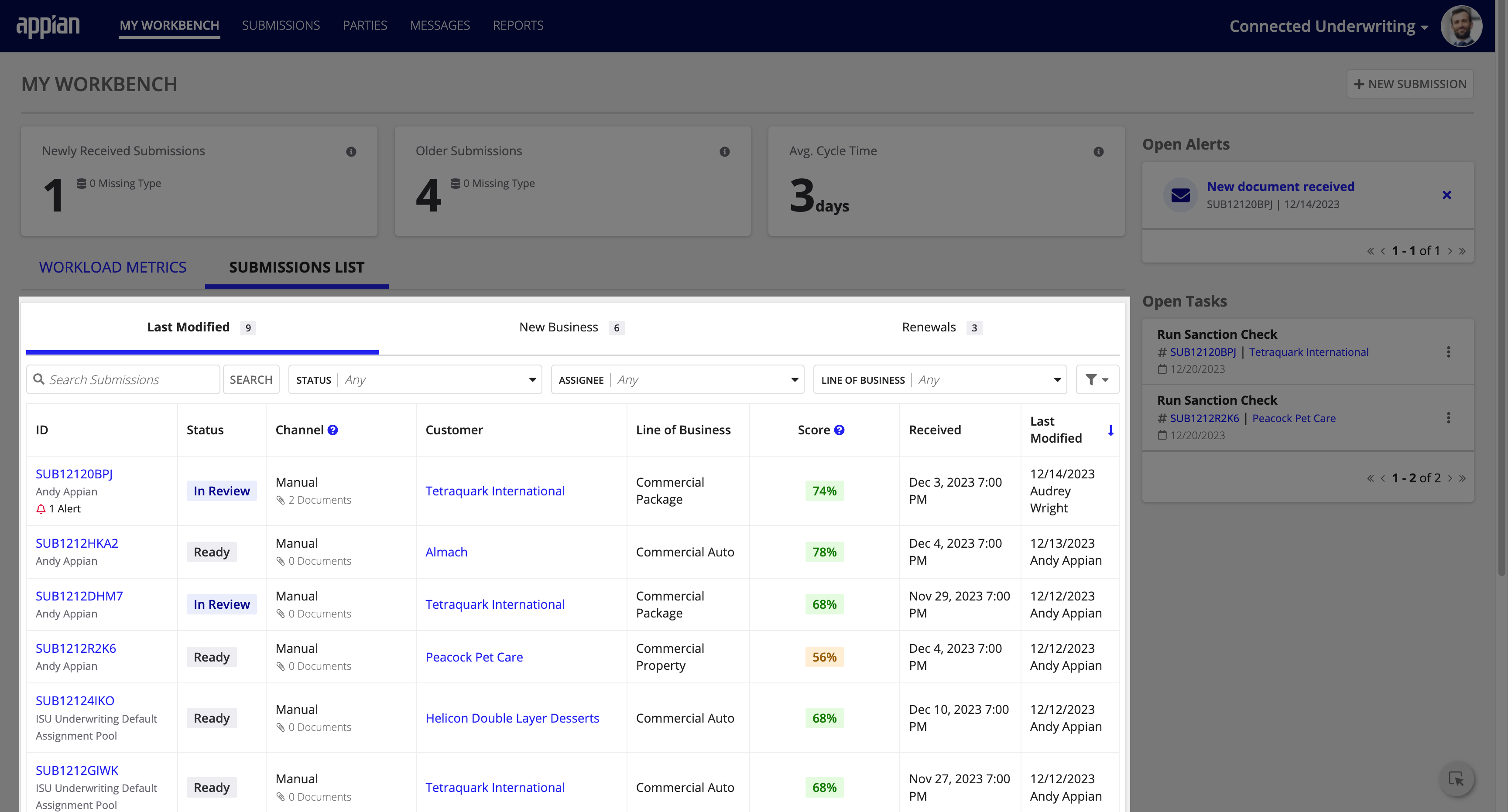

TriageCopy link to clipboard

With Connected Underwriting, underwriters can quickly prioritize workloads based on their business needs. Underwriters can filter for new business submissions or renewals, and sort submissions based on their submission scores, which are powered by their business rules.

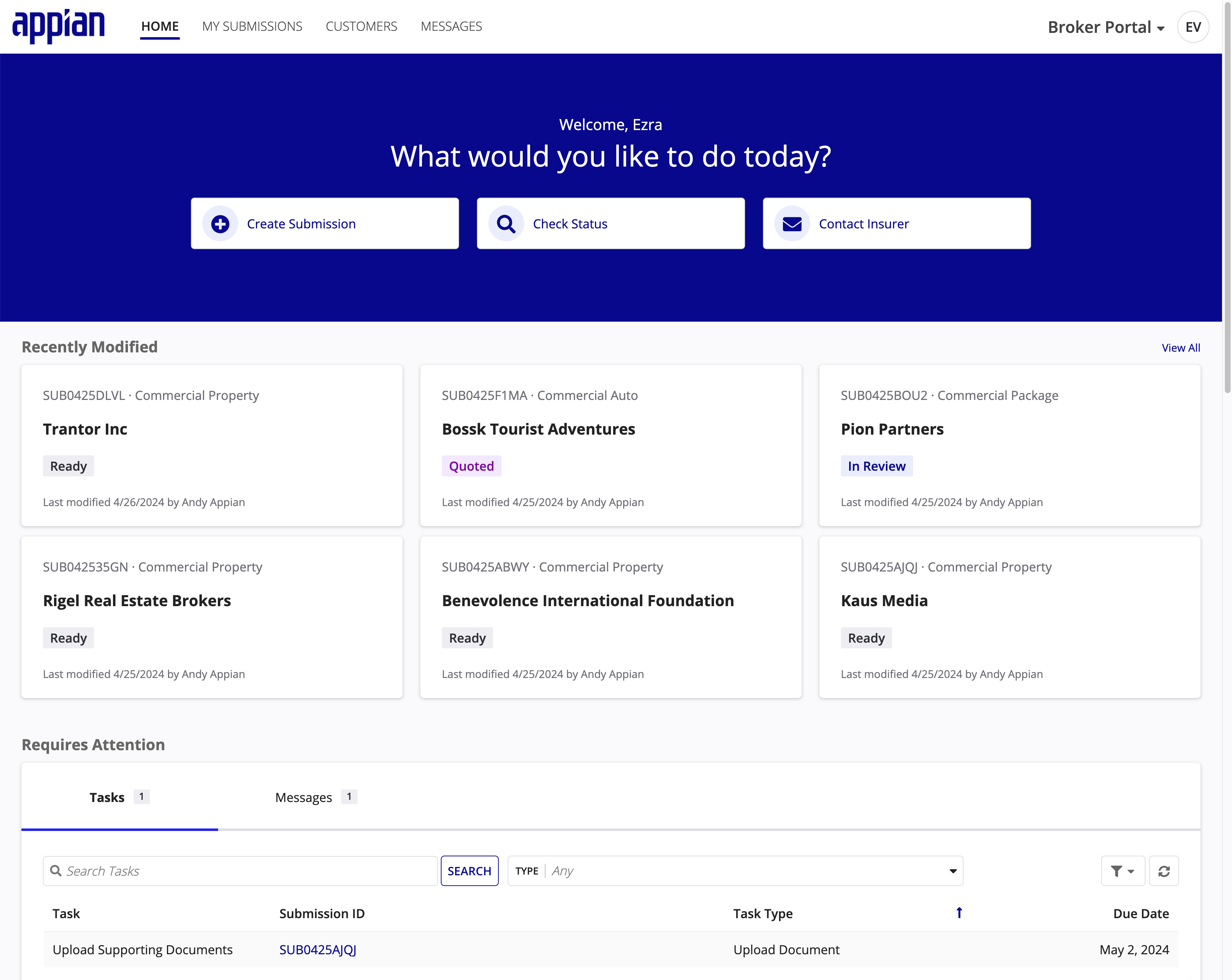

Authenticated Broker PortalCopy link to clipboard

Connected Underwriting P&C ships with the Authenticated Broker Portal module, which enables brokers with a registered and verified account to manage their submissions once the module is integrated with the solution.

The Authenticated Broker Portal module allows brokers to create new submissions, check the submission status, view and track their assigned tasks, upload submission documents, and communicate with insurance carriers and underwriting teams.

Get startedCopy link to clipboard

Ready to get started? Check out the topic browser on the left to see all of the content covered in the Connected Underwriting documentation.