| This content applies solely to Connected Underwriting, which must be purchased separately from the Appian base platform. |

IntroductionCopy link to clipboard

Appian Connected Underwriting (CU) P&C empowers insurers with a powerful tool to accelerate the underwriting process and improve customer experience. This page provides a quick overview of how Appian Connected Underwriting P&C can help insurance organizations improve their time to quote.

CU P&C provides a single application to consolidate disparate data sources. By reducing the time needed to gather critical information, organizations can accelerate their ability to provide accurate quotes.

If you want a comprehensive solution overview, check out Using Connected Underwriting P&C, starting with the Workbench Overview.

What does Appian Connected Underwriting P&C provide?Copy link to clipboard

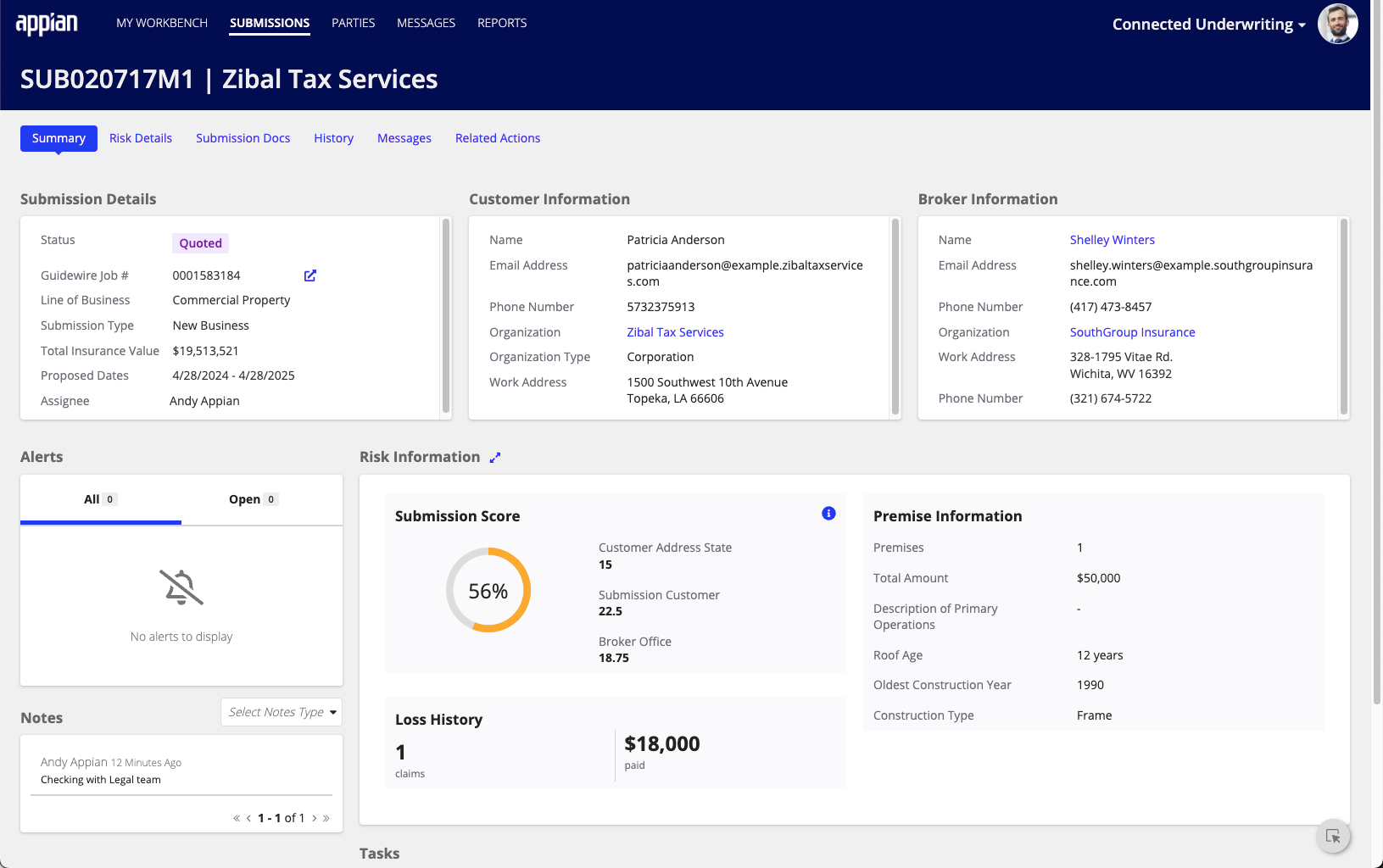

Appian CU P&C streamlines the business-to-quote process by automating the ingestion, clearance, and triage of information needed for an underwriting Submission. The Submission is the key record in underwriting activities.

They are created in two ways:

- Via emails received from insurance brokers.

- Manually created by an underwriter.

Data ingestionCopy link to clipboard

CU P&C uses Appian AI Skills to extract critical data from shared inboxes and incoming submissions. By extracting critical information needed for review, your underwriters are empowered to make the decisions necessary to lead the underwriting process and reduce the time to quote.

In addition, CU P&C ships with the Guidewire Quote module, which streamlines the quote generation process. Once integrated with the solution, the Guidewire Quote module allows your underwriters to submit new business requests from CU P&C and have the data automatically sent to Guidewire. In addition, you can check your submission against existing customers, create a new customer, create a job, and pass the information downstream.

Submission clearanceCopy link to clipboard

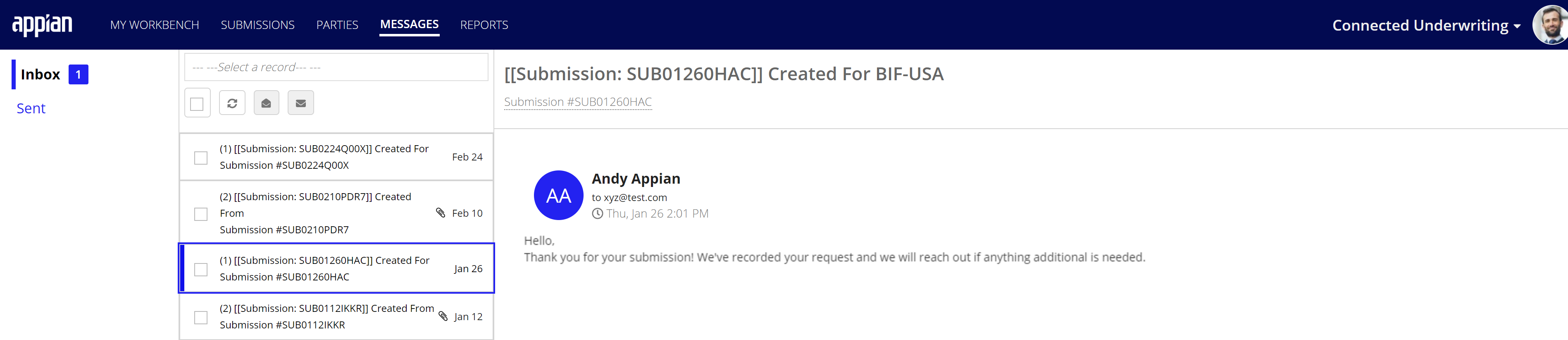

Connected Underwriting allows underwriters to keep track of broker correspondence with AI message summaries, quickly respond with automated emails and follow-ups, ensure submission data completeness, comply with sanctions regulations, and alert underwriters if duplicate submissions exist.

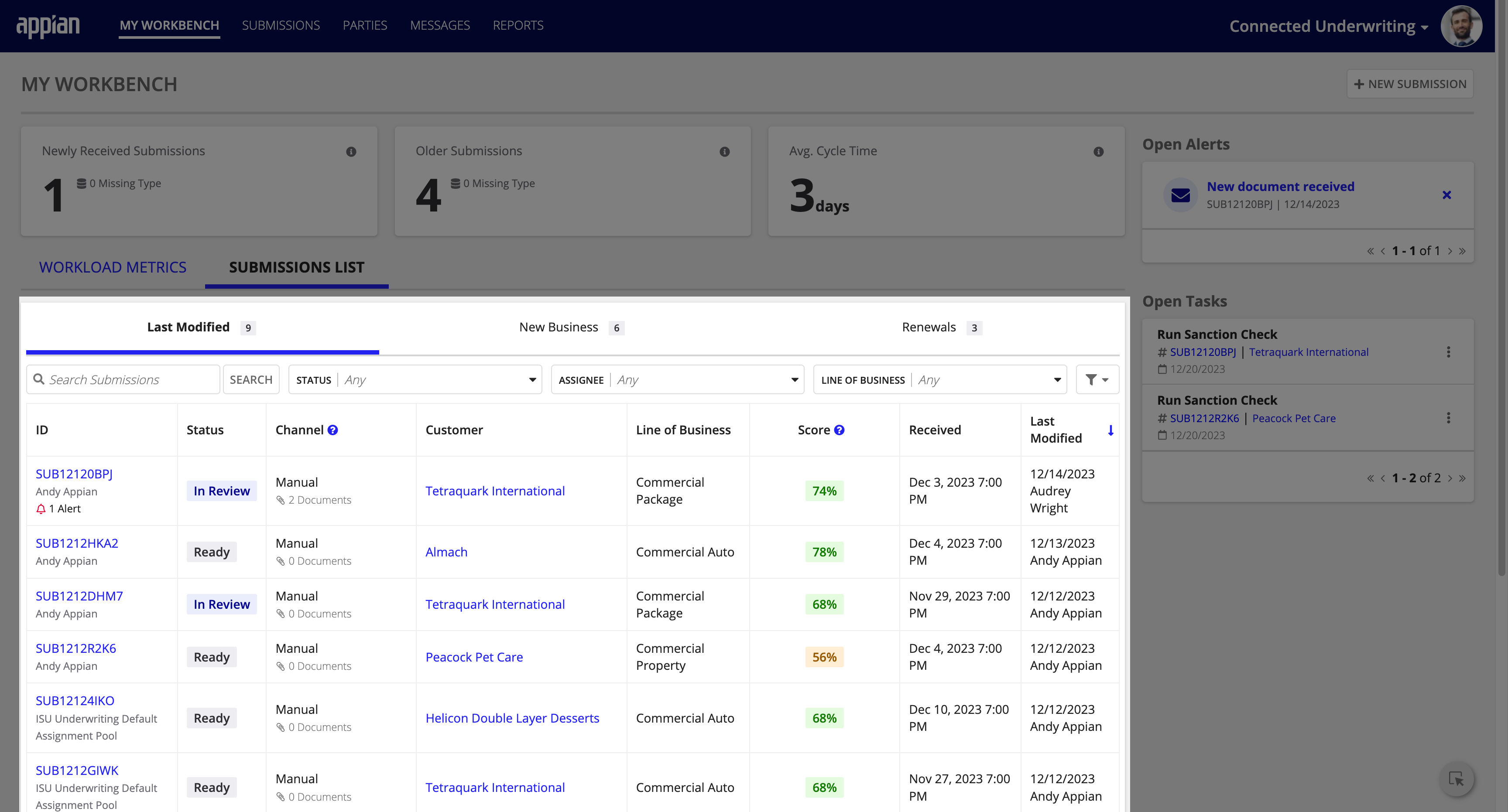

TriageCopy link to clipboard

With Connected Underwriting, underwriters can quickly prioritize workloads based on their business needs. Underwriters can filter for new business submissions or renewals and sort submissions based on their submission scores, which are powered by their business rules.

Extending CU P&CCopy link to clipboard

In addition to the out-of-the-box capabilities that ship with CU P&C, you can further extend the solution's capabilities by incorporating add-on modules built specifically to accompany it. These modules include:

| Add-on Module | Extended Capabilities |

|---|---|

| Authenticated Broker Portal Module | Enables brokers with a registered and verified account to create new submissions and manage their existing submissions. |

| Automated Routing Module | Allows administrators and managers to define and manage rules for automatically assigning and routing submissions within the system. |

| Guidewire Quoting Module | Allows users to pass submission data from the CU P&C solution to Guidewire so underwriters can generate quotes for multiple lines of businesses in Guidewire's PolicyCenter. |

| OpenAI Module | Allows underwriters to summarize message threads with the help of OpenAI. |

| Referral Task Module | Allows users to select a Referral task type when creating tasks within the submission and assign tasks for peer or manager review. |

| Submission Record AI Chat | Enables users to interact with the AI chatbot to get answers about a submission. |

Get startedCopy link to clipboard

Ready to get started? Check out the topic browser on the left to see all the content covered in the Connected Underwriting documentation.