| This content applies solely to Connected Claims, which must be purchased separately from the Appian base platform. This content was written for Appian 24.2 and may not reflect the interfaces or functionality of other Appian versions. |

What's New in Connected Claims?Copy link to clipboard

The Connected Claims 24.2.1.0 release notes provide an overview of the latest changes and improvements to the Connected Claims solution. New features and improved capabilities were designed with best practices in mind.

Bulk claims reassignmentCopy link to clipboard

You may encounter situations where your claims manager needs to assign existing claims to a different team member. This may occur when a claims adjuster is no longer with your agency or has been transferred to another team. Previously, the only way to do this was to manually reassign each claim individually. This process is time-consuming, especially when the previous adjuster had multiple claims.

This release introduces Bulk Claims Reassignment, which streamlines the assignment process by allowing claims managers to reassign claims in bulk. Now, your claims manager can reassign new and ongoing claims to a different claims adjuster by selecting all the claims that need to be reassigned from the Recent Claims list and then selecting the specific user to whom the claims will be reassigned. Once the manager confirms the reassignment, the case owner of the selected cases will be changed accordingly, and you can view the change in the case summary.

New Life LOB workflowCopy link to clipboard

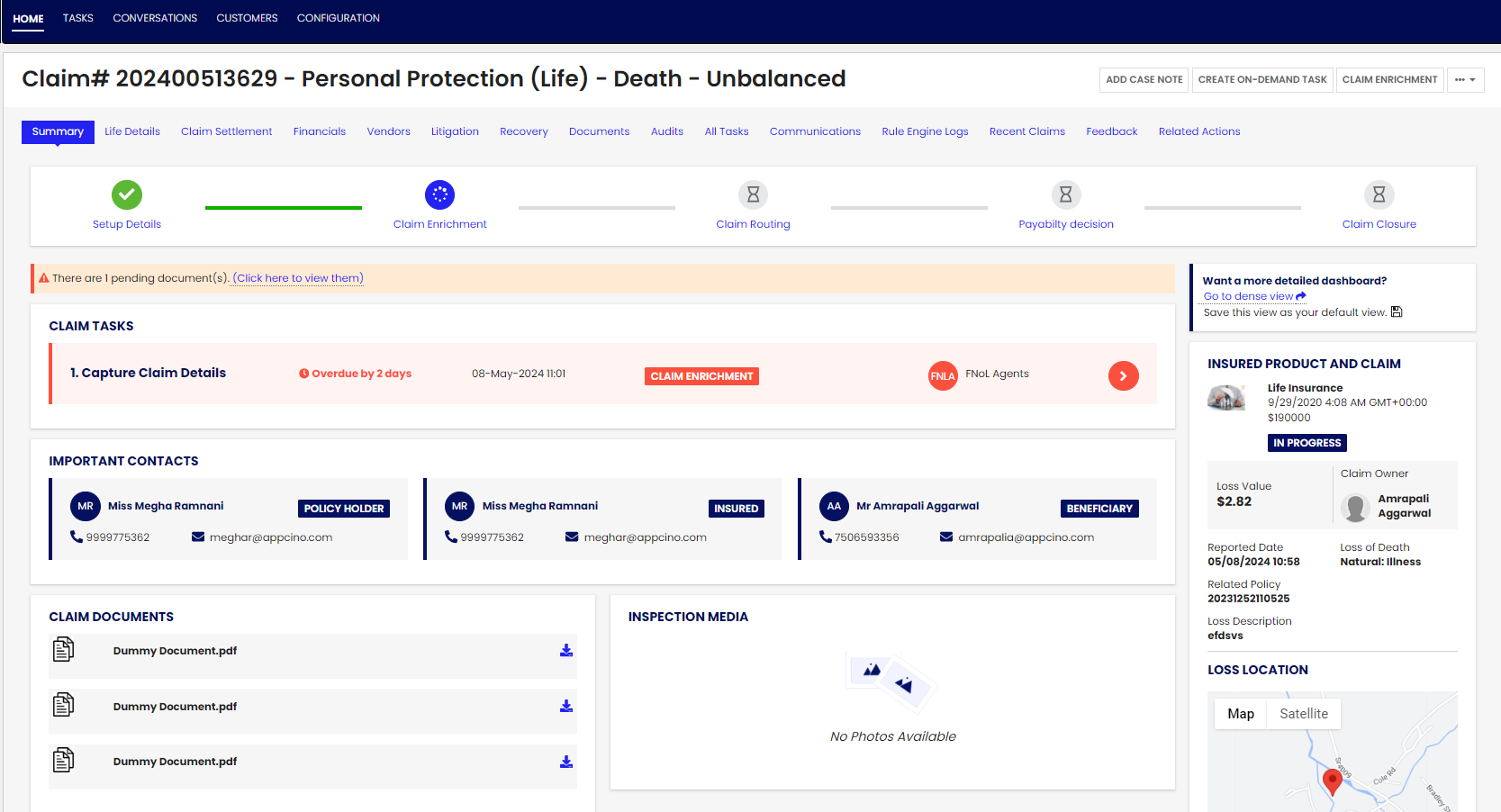

We also enhanced the Personal Protection Life LOB workflow with additional features that allow you to log and process term-life and whole-life insurance claims directly in your Connected Claims solution.

With this newly enhanced Personal Protection Life LOB workflow, you can:

- Perform intake activities, log claims, and carry end-to-end claims processing for life insurance-related policies, while analyzing and tracking relevant data points throughout the process.

- Use new business rules to set up claim reserves, such as expense loss and recovery.

- Utilize Connected Claims' omni-channel capabilities to customize the base process and the business rules to match your organization's workflow needs.

- Log claims in different currencies, and Connected Claims showing the claim amounts in base and logged currencies based on the conversion rate of the currency on the claim registration date.

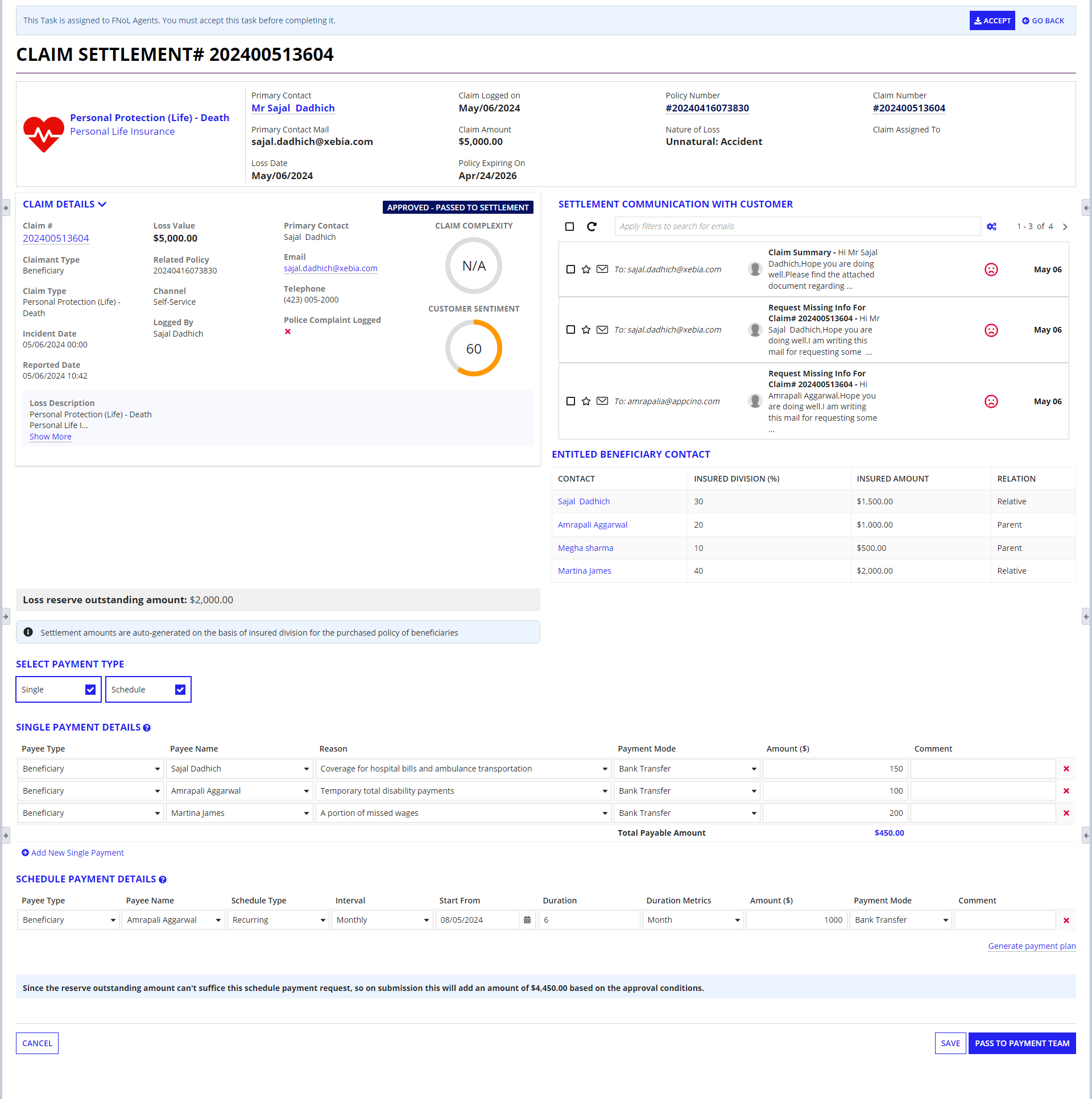

In addition, the policy beneficiary can log a claim, and beneficiaries will receive the insured amount based on their specified percentage in the policy details, which is determined by the system when processing and settling the claim.

Improved Worker Compensation workflowCopy link to clipboard

We've extended the Worker Compensation workflow, allowing claimants to process worker compensation claims for short-term and long-term disability or death faster. New business rules allow you to configure auto-adjudication and set up conditions to allow the Connected Underwriting P&C solution to determine the settlement amount based on policy parameters like benefit percentage and base period. This maximizes touchless claims for faster settlement.

Expanded claims capabilitiesCopy link to clipboard

This release also expands the solution's claims capabilities, allowing you to split, merge, and clone existing claims.

Split claimsCopy link to clipboard

Splitting a source claim into two separate claims with different lines of business (LOBs) but the same customer can save time and effort and reduce errors associated with manual claim processing. For instance, if a deceased policyholder had two policies with the same insurance company - workers compensation and term life - a system that enables an adjuster to split the claim into two separate claims to ensure the proper documentation, evaluation, and processing of the policyholder's death against the right policy, by the right adjuster, will allow your team to process claims more efficiently.

The Split Claim feature allows you to split a logged claim with two different LOBs for the same customer into two separate claims. This allows you to assign each claim to the adjusters with the appropriate expertise to process each claim correctly.

To access this feature, open the source claim, navigate to the Related Actions tab, and click Split Claim. This will open a new claim in the editable format, allowing you to copy loss details, documents, and communications from the source claim into a new claim. Once the necessary information is copied over to the new claim, you can add line of business (LOB) details and upload the required documents. In addition, Connected Claims will pre-populate the metadata from the source claim in the new claim, saving you the effort of manually entering this data.

Merge claimsCopy link to clipboard

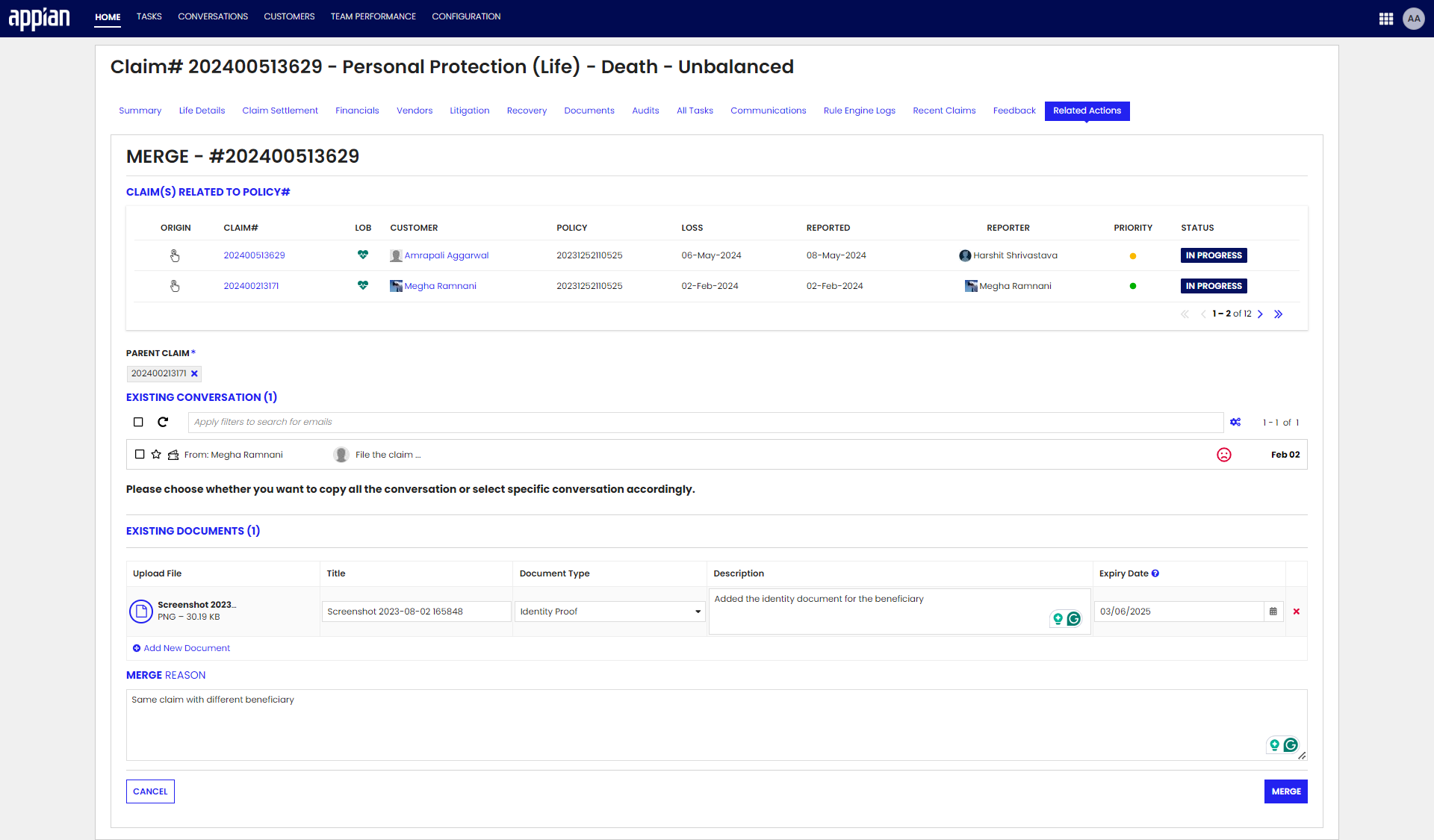

In certain instances, an incident can be logged by multiple beneficiaries, which increases the occurrence of multiple adjusters processing the same claim at the same time. To prevent this, organizations need a way to merge claims that have a common customer, loss details, and policy number.

Connected Claims introduces a Merge Claim feature on the Related Actions tab in the Claim record. The Merge Claim feature allows adjusters to merge an ongoing claim with any other open claims related to the same customer policy and the same loss amount. This helps adjusters process claims in a focused manner, saving time and reducing operation redundancies.

To use this feature, open an existing claim and navigate to the Related Actions tab to see if there are any claims that relate to the policy number associated with the source claim. All matching claims can be found in the MERGE list. If there are related claims, click MERGE to copy all relevant documents and conversations from the related claims to the source claim. Note that this action can only be performed on source claims that have not undergone any steps in the claim process. If the source claim is being processed, no information will be copied over.

Clone existing claimsCopy link to clipboard

This release introduces the Cloning Existing Claims feature to expedite claim processing and ensure consistency across cases. This feature simplifies the user experience by enabling FNOL agents to clone an existing claim in the same line of business (LOB).

During the clone process, the basic metadata of the claim will be copied to a new claim. Once copied, you can upload documents and add claim parties to the newly created claim. The cloned claim is visible under the related entity section of the claim.

Additional UpdatesCopy link to clipboard

This release also includes several UX enhancements to improve the overall user experience, including:

- An enhanced Claims list and view and Customer record to provide more data insights.

-

An option for switch between a focused claim view with user-selected information or a dense view that displays all information by default.

Resolved general issues and bug fixesCopy link to clipboard

The following issues were resolved in Connected Claims 24.2.1.0:

- Resolved Issues Creating New Lines of Business (LOBs) - High Resolved an issue that caused data dumping in all related tables for newly created lines of business.

- Resolved Task Assignment Issues - Medium Resolved an issue that caused the task assignment to break when assigning a task to a user who is part of multiple groups.

- ResolvedExport Journey Framework Issue - Medium Resolved the issue that prevented required data from being automatically populated when exporting a journey.

- Removed Execute Stored Procedure Plugin Dependency - Medium Removed this plug-in dependency from the system, marking a significant advancement that streamlines processes, ensures smoother workflows, and improves system performance.

- Removed the Google Cloud AutoML Connected System Dependency - Low This Appian plug-in uses a deprecated version of Google AutoML. After Google shuts down these services, the Google Cloud AutoML connected system plug-in will no longer function in Appian. Hence, the dependency is removed.