| This content applies solely to Connected Underwriting Life, which must be purchased separately from the Appian base platform. |

IntroductionCopy link to clipboard

The Appian Connected Underwriting (CU) Life offers pre-built integrations to several add-on modules that allow you to extend the capabilities of your CU Life solution. Once incorporated with your CU Life solution, these integrations will allow you to automate case assignments to specific team members or groups, create, setup, and aggregate custom reports using different data sources, evaluate and classify risk directly from the solution.

This guide provides a quick overview of all the benefits of each add-on module delivers and they can help you streamline your underwriting process.

Auto-AssignmentCopy link to clipboard

Want to provide your teams with greater flexibility to manage assignments and ensure they have visibility into the right cases? Or ensure your managers can effectively balance workload distribution across their entire team? Integrating the Auto-Assignment Add-On module with your CU Life solution enables you to streamline your underwriting process by automating case assignments to groups or team members based on a set of pre-defined case conditions.

For example, if have a Large Case team that works on cases with value amounts greater than $100K, the Auto-Assignment integration allows you to configure a rule to automatically assign and route cases to the this team when the case value exceeds this amount.

After installing and integrating the Auto-Assignment module to your CU Life solution, the application creates a user-configurable assignment wizard as part of the Admin Settings site. This will give your administrators and managers the ability to configure case rules that automatically assign and route cases to the appropriate underwriting team when they match certain case criteria.

See Integrating Auto-Assignment to incorporate the Auto-Assignment Add-On module with your CU Life solution.

End-User ReportingCopy link to clipboard

The End-User Reporting Add-On Module (SEUR), is a standalone, customizable application built on the Appian low-code platform that allows underwriting managers to create, setup, and aggregate custom reports using different data sources.

Once installed and incorporated with your Connected Underwriting Life solution, your underwriting managers can create a number of custom and on-demand reports leveraging the data from your data management systems and view them on customizable dashboards that you can stylize to fit your brand and business needs.

Self-Service Reporting CapabilitiesCopy link to clipboard

The SEUR application gives your underwriting team greater control over the types of reports they want to see and reduces their reliance on your internal development team to create custom reports. With SEUR, users can create and configure tailored reports from data within the Connected Underwriting solution, giving them quicker access to critical insights that can lead to faster decision making, a more flexible and responsive workflow, and a more efficient underwriting process. In addition, since the custom reports live in the SEUR application, users can save them to a dashboard for frequent use or store them to generate on demand.

The site includes a guided workflow that provides users with a number of self-service capabilities, like selecting the data source and data limit, which determines the number of rows the report returns. The application also provides a range of report types, allowing users to determine how they want to visualize the data in grid format or various chart types.

Additionally, reports can be created with flexible filters, allowing for real-time, historic reporting and sharing with other users.

Customized Dashboard ViewsCopy link to clipboard

Users can also create and customize multiple report dashboards to display specific reports in a specific order and layout. Easily add names, actions, and filters to your dashboards so users can take action on a report and filter the reports to show only the data they want to see. Dashboard visibility allows users to control who has access to view it.

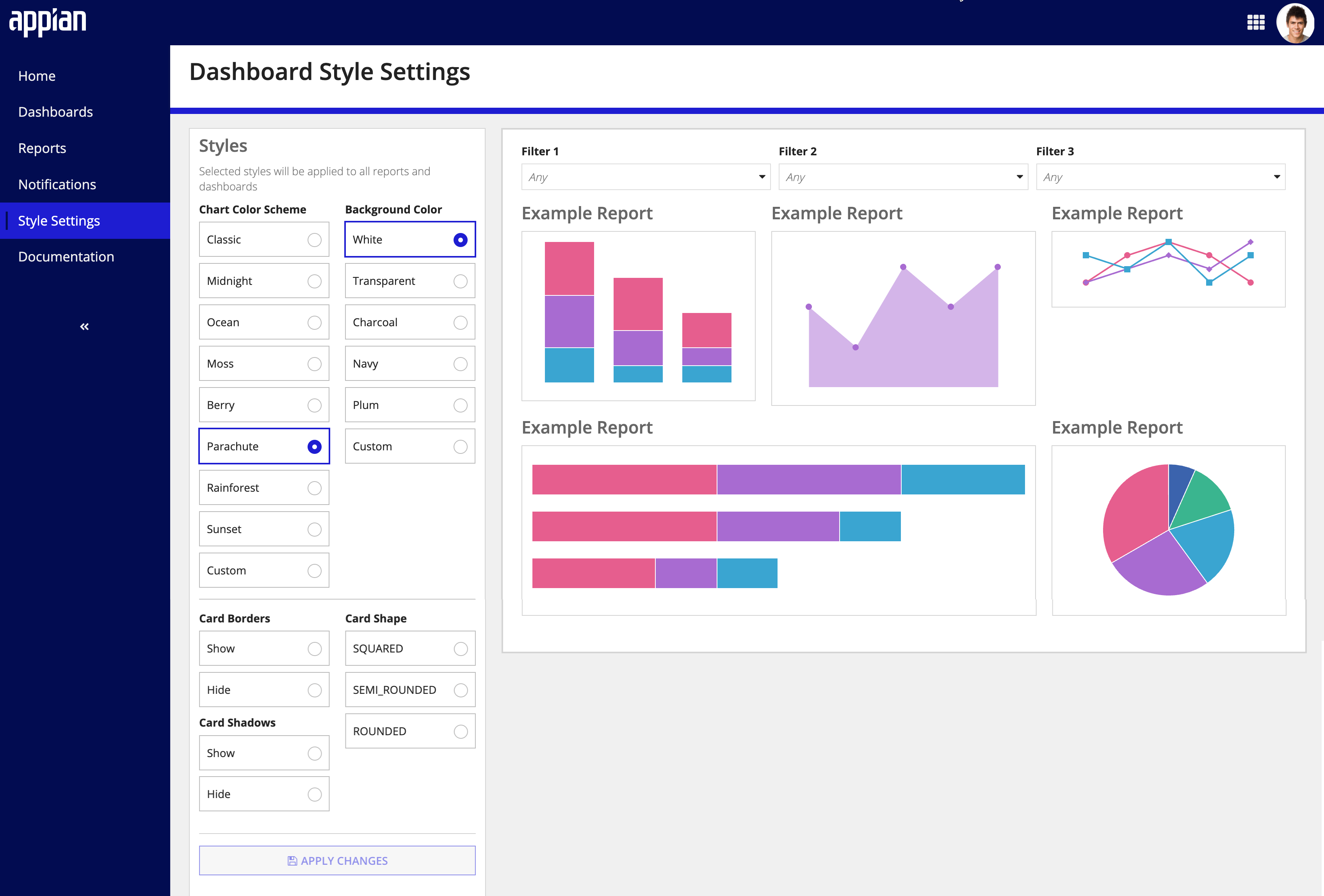

Selectable Layout Styles and Color SchemesCopy link to clipboard

The End-User Reporting module includes custom color schemes giving users more control over the style and visual display of their reports and dashboard. Users can select from a set of modern and unified color scheme options and background colors to apply to all their reports and dashboard view.

In addition, users can select the style and shape of the report cards that display on the report dashboard.

Schedule Report NotificationsCopy link to clipboard

Easily configure the schedule and frequency you want specific user groups or recipients to receive an email notification about a specific report or dashboard.

Magnum Pure IntegrationCopy link to clipboard

The Magnum Pure integration is an influential automated underwriting solution powered by Swiss Re’s Life Guide. It helps underwriters better evaluate and classify risk, handle exceptions, and make critical case decisions, spending less time on procedural and administrative steps, transactions, and keystrokes.

With the Magnum Pure integration, a rules engine allows your underwriters to capture the information they need to process and assess the risk for a new life insurance application, simplifying and accelerating the process of capturing new business.

See Integrating Magnum Pure to incorporate the Magnum Pure Add-On module with your CU Life solution.

Ready to extend your CU Solution?Copy link to clipboard

You must deploy and set up these add-on modules to work with your CU Life solution.